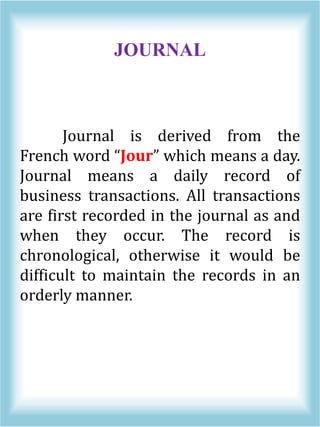

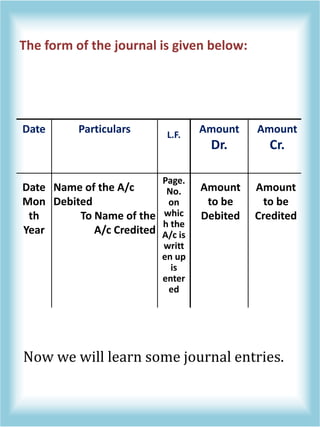

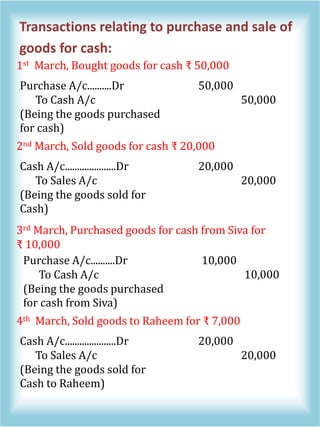

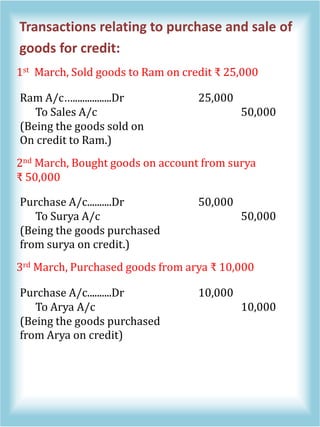

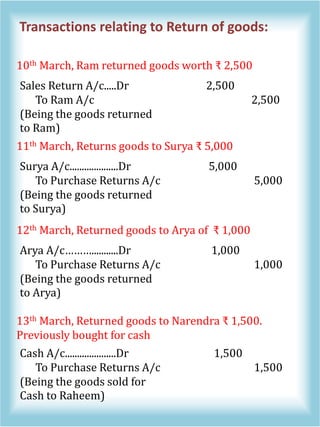

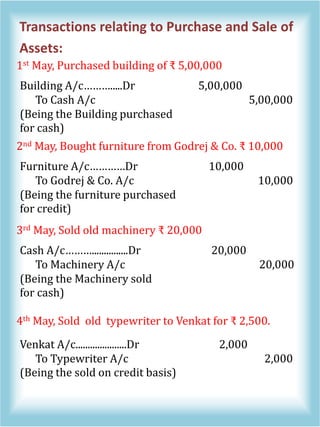

The document introduces basic accounting concepts, focusing on the journal, which records business transactions chronologically. It provides various examples of journal entries for cash and credit transactions, including purchases, sales, returns, and asset transactions. The author indicates that future posts will cover additional accounting topics related to income, expenses, and other financial transactions.