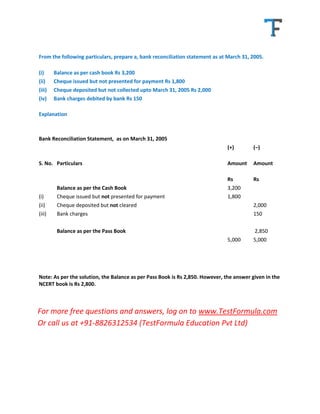

The document discusses reasons for differences between bank balances shown in a passbook versus a cash book. Key reasons include timing lags between transactions being recorded in each book, outstanding checks, and fees/interest only recorded in one book. It provides examples like interest charged by the bank only appearing in the passbook initially. The document also shows how to prepare a bank reconciliation statement to reconcile the two balances based on reconciling items like outstanding checks and deposits.