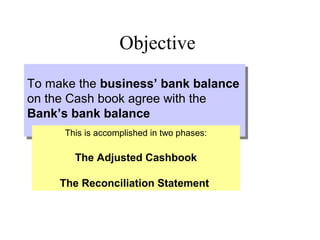

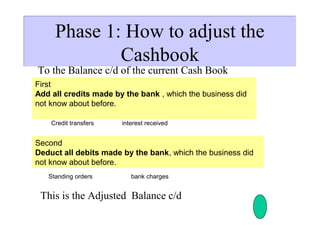

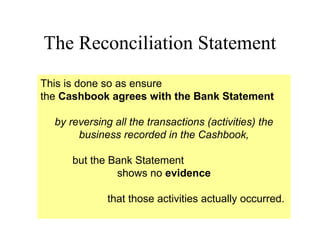

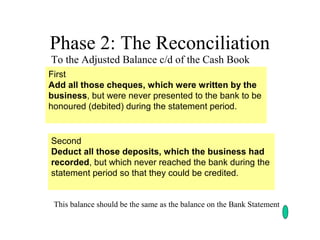

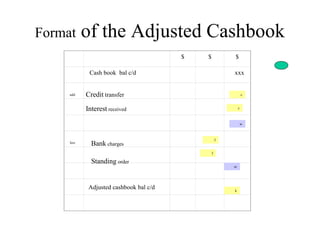

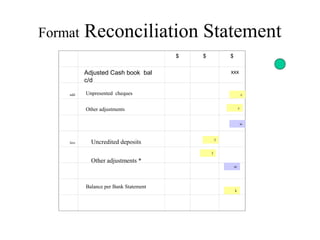

This document discusses how to reconcile a business's bank balance recorded in the cashbook with the balance shown on the bank statement. It is a two-phase process: 1) Adjusting the cashbook balance by adding credits and deducting debits made by the bank that were unknown, and 2) Creating a reconciliation statement that reconciles the adjusted cashbook balance with the bank statement balance by adding outstanding deposits and deducting uncleared checks. The goal is to make the cashbook and bank statement balances agree by accounting for any discrepancies between the two records.

![The Adjusted Cashbook

This is done so as to update

the bank a/c in the Three Column Cashbook

with the transactions (activities), which the

BANK performed on your behalf, but ‘unknown’

to you

[as shown on your BANK STATEMENT].](https://image.slidesharecdn.com/bankreconciliation-121122200148-phpapp02/85/Bank-reconciliation-3-320.jpg)

![terminology

••Reconcile

Reconcile -to make things agree

-to make things agree

••Standingorder ––an instruction to the banker to pay aaspecific party aaspecified

Standing order an instruction to the banker to pay specific party specified

sum for aaspecified period on aaregular basis [monthly]

sum for specified period on regular basis [monthly]

••Credittransfer ––aadeposit made to one’s account directly through the banking

Credit transfer deposit made to one’s account directly through the banking

system

system

••Bankcharges ––fee or penalties incurred upon using the banking facilities

Bank charges fee or penalties incurred upon using the banking facilities

••Dishonouredcheque ––aacheque which the bank could not cash (honour) because

Dishonoured cheque cheque which the bank could not cash (honour) because

of aatranscription error or insufficient funds [RD]

of transcription error or insufficient funds [RD]

••Unpresentedcheques ––cheques which creditors have not presented for payment

Unpresented cheques cheques which creditors have not presented for payment

••BankStatement ––aareport from the bank showing the dated transaction and

Bank Statement report from the bank showing the dated transaction and

activities that occurred to your account over the period. It generally uses aa

activities that occurred to your account over the period. It generally uses

continuous balance.

continuous balance.

••UncreditedDeposits ––deposits which have not been lodged/ recoreded on the

Uncredited Deposits deposits which have not been lodged/ recoreded on the

bank statement.

bank statement.](https://image.slidesharecdn.com/bankreconciliation-121122200148-phpapp02/85/Bank-reconciliation-9-320.jpg)