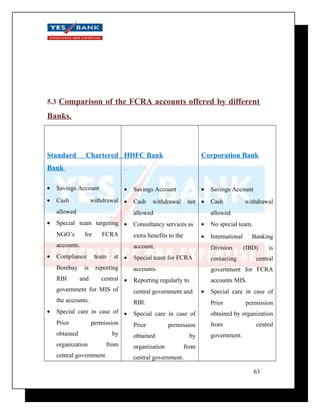

The document provides an overview and introduction to the Foreign Contribution (Regulation) Act 1976 in India. Some key points:

- The Act regulates the acceptance and use of foreign contributions by certain individuals and organizations to ensure it does not compromise national security or elections.

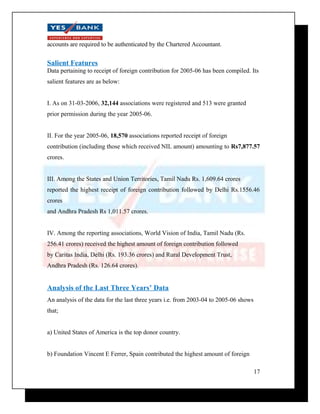

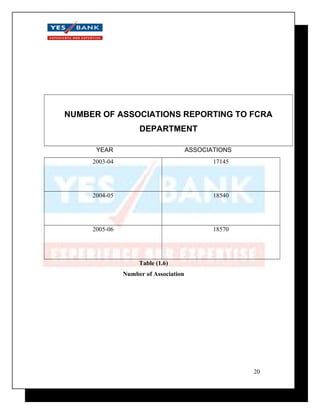

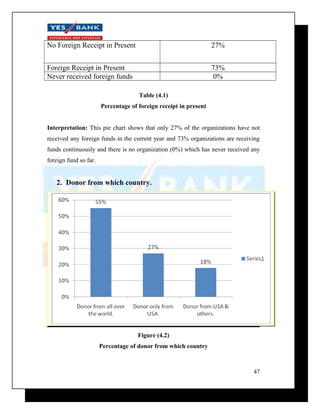

- Organizations need prior permission or registration to receive foreign funds. Registered organizations must maintain separate accounts and submit annual audited reports.

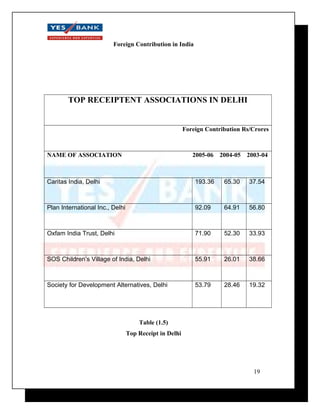

- Over 34,000 organizations are registered under the Act across religious, cultural, economic, educational and social categories. The top recipient states are Tamil Nadu, Delhi, and Andhra Pradesh.

- The Act also regulates foreign hospitality received by certain public officials and politicians to/from foreign countries.