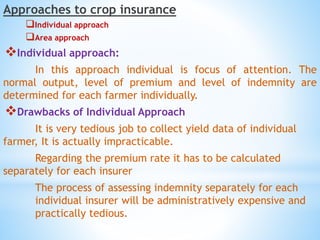

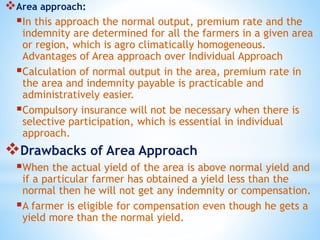

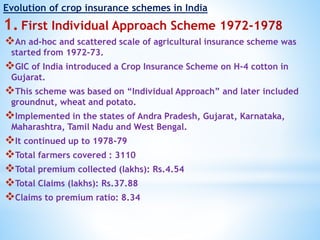

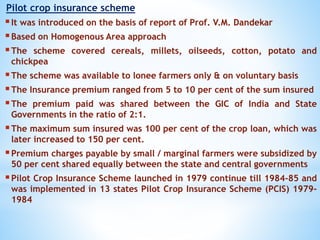

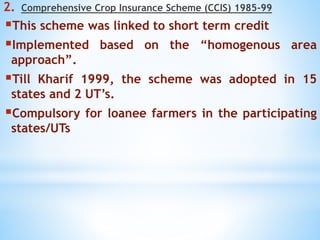

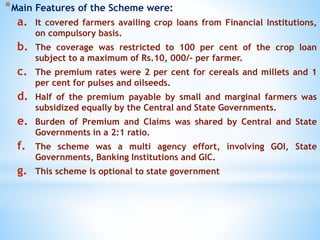

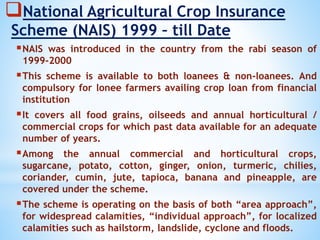

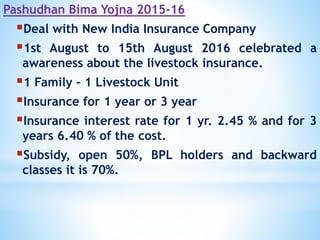

This document provides an overview of crop insurance in India, including the various approaches, concepts, types of crop insurance schemes, and the evolution of crop insurance in India. It discusses the National Agricultural Insurance Scheme and its key challenges, as well as the Weather Based Crop Insurance Scheme. It also briefly covers livestock insurance schemes in India.