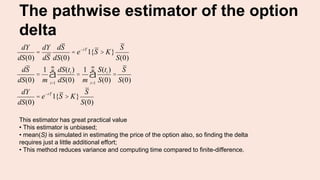

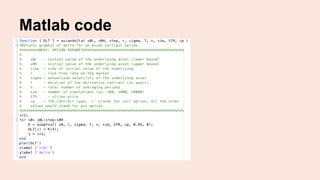

The document discusses the computation of the delta of an arithmetic Asian option using Monte Carlo simulation and the pathwise method. It includes a detailed mathematical model, MATLAB code for simulations, and the estimation of option values and confidence intervals. The pathwise estimator is highlighted for its unbiased nature and efficiency in reducing variance and computational time compared to finite-difference methods.

![The price of an Asian option by MCS

An Asian option (call) has discounted payoff:

Y = e-rT

[S - K]+

S =

1

m

S(ti )

i=1

m

å For fixed dates 0<t1<…<tm<T

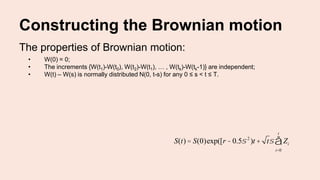

Since for Monte Carlo simulation we describe the risk-neutral dynamics of the stock price, we

need to use the stochastic differential equation for modeling the price movement of the

underlying asset

S(T) = S(0)exp([r -

1

2

s 2

]T +sW(T))

Where W(T) is the random variable,

normally distributed with mean 0 and

variance T.](https://image.slidesharecdn.com/assignment15borisova-150306084810-conversion-gate01/85/The-Delta-Of-An-Arithmetic-Asian-Option-Via-The-Pathwise-Method-4-320.jpg)

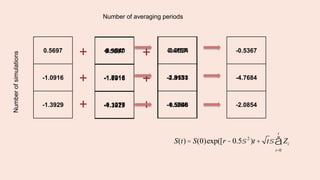

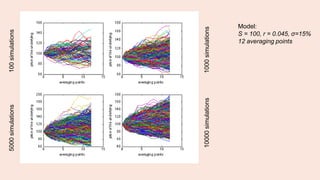

![S(T) = S(0)exp([r -

1

2

s 2

]T +sW(T))

Monte Carlo simulation of the

lognormal asset price movement

Model:

S = 100, r = 0.045, σ=15%,

trials = 100000

For fixed dates 0<t1<…<tm<T](https://image.slidesharecdn.com/assignment15borisova-150306084810-conversion-gate01/85/The-Delta-Of-An-Arithmetic-Asian-Option-Via-The-Pathwise-Method-5-320.jpg)

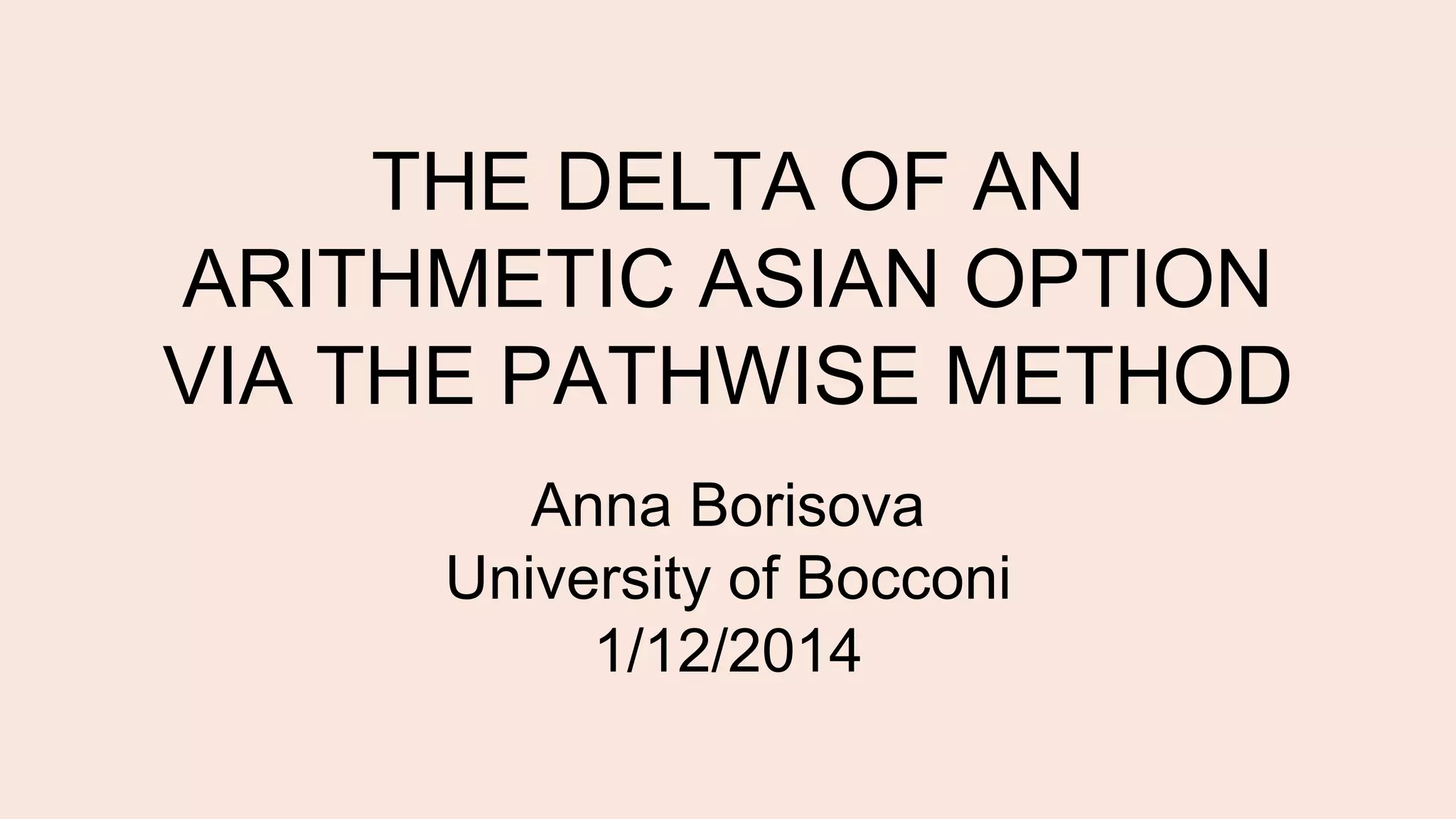

![Option value estimation and its

confidence level

The sample standard deviation

sC =

1

n-1

(Yi - ˆYn )2

i=1

n

å

1-δ quantile of the standard normal distribution zdConfidence interval:

ˆYn ± zd/2

sC

n

ˆYn =

1

n

Yi

1

n

å

E[ ˆYn ]= Y

ˆYn -Y

sC / n

Þ N(0,1)

The estimation of the option value is unbiased

As number of replications increases, the standardized estimator converges in

distribution to the standard normal](https://image.slidesharecdn.com/assignment15borisova-150306084810-conversion-gate01/85/The-Delta-Of-An-Arithmetic-Asian-Option-Via-The-Pathwise-Method-10-320.jpg)