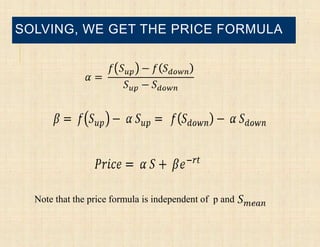

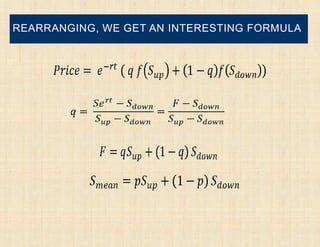

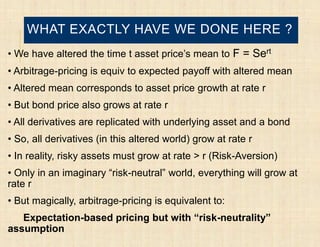

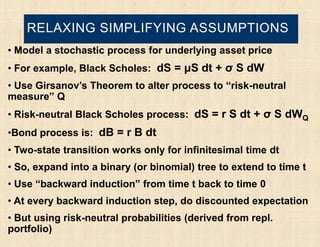

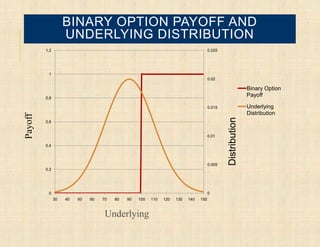

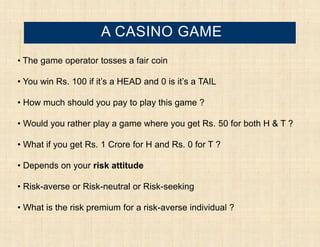

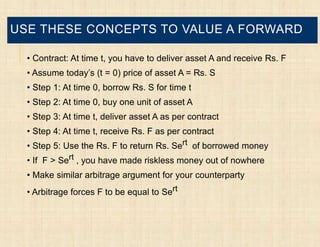

This document introduces the concepts of risk-neutral valuation and derivative pricing. It defines derivative securities as contracts contingent on the value of an underlying asset. The key questions in pricing derivatives are determining the expected payoff and the information required to calculate it. The document explains how replication arguments and preventing arbitrage opportunities can be used to derive fair prices for forwards, calls, puts and other derivatives under the risk-neutral measure, where the expected return on the underlying asset is equal to the risk-free rate. Relaxing simplifying assumptions, more advanced stochastic models can also be used for risk-neutral pricing.

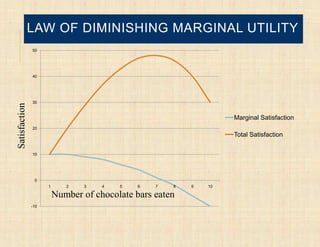

![LAW OF DIMINISHING MARGINAL UTILITY

• Note that the total utility function f(x) is concave

• Let x (qty of consumption) be uncertain (some probability distribution)

• Then, E[ f(x) ] < f( E[x] ) (Jensen’s inequality)

• Expected Utility is less than Utility at Expected Consumption

• Consumption y that gives you the expected utility: f(y) = E[ f(x) ]

• So, when faced with uncertain consumption x, we will pay y < E[x]](https://image.slidesharecdn.com/risk-neutralpricing2010-120925075235-phpapp02/85/Introduction-to-Risk-Neutral-Pricing-6-320.jpg)

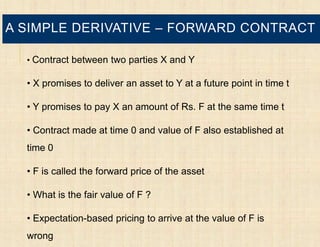

![LAW OF DMU RISK-AVERSION

• E[x] is called the expected value

• y is called the “certainty equivalent”

• y – E[x] is called the “risk premium”

• y – E[x] depends on the utility concavity and distribution

variance

• More concavity means more risk premium and more risk-

aversion

• So to play a game with an uncertain payoff, people would

Generally pay less than the expected payoff](https://image.slidesharecdn.com/risk-neutralpricing2010-120925075235-phpapp02/85/Introduction-to-Risk-Neutral-Pricing-7-320.jpg)

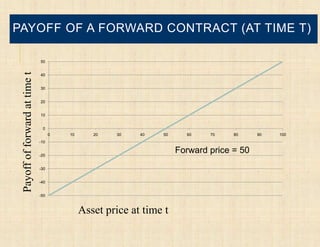

![REPLICATING PORTFOLIO FOR A FORWARD

• A Forward can be replicated by fundamental securities

• Fundamental Securities are the Asset and Bonds

• “Long Forward”: At time t, Receive Asset & Pay Forward Price

F

• “Long Asset”: Owner of 1 unit of asset

• “Long Bond”: Lend money for time t (receiving back Rs.1 at t)

• “Short positions” are the other side (opposite) of “Long

positions”

• “Long Forward” equivalent to [“Long 1 Asset”, “Short F

Bonds”]

• Because they both have exactly the same payoff at time t

• This is called the Replicating Portfolio for a forward](https://image.slidesharecdn.com/risk-neutralpricing2010-120925075235-phpapp02/85/Introduction-to-Risk-Neutral-Pricing-13-320.jpg)