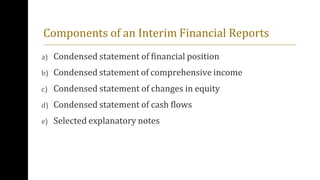

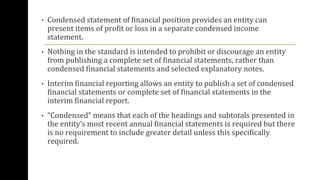

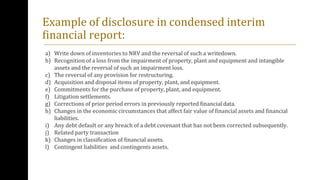

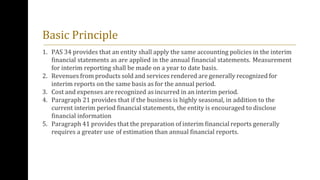

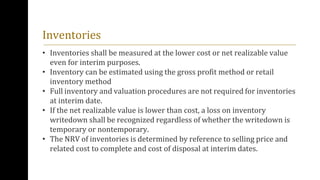

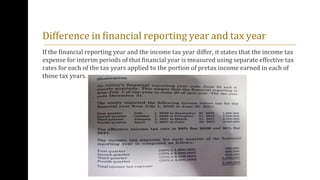

This document discusses interim financial reporting. It provides definitions and components of interim financial reporting, including that it involves preparing financial statements for periods less than one year, such as quarterly or semi-annually. The document outlines requirements for Philippine entities to file quarterly interim reports within 45 days of quarter-end. It describes the key components of interim financial reports as condensed financial statements and selected explanatory notes. It also provides guidance on recognition, measurement and disclosure for items in interim reports, including inventories, revenues, costs, and income taxes. Comparative interim statements are to be presented.