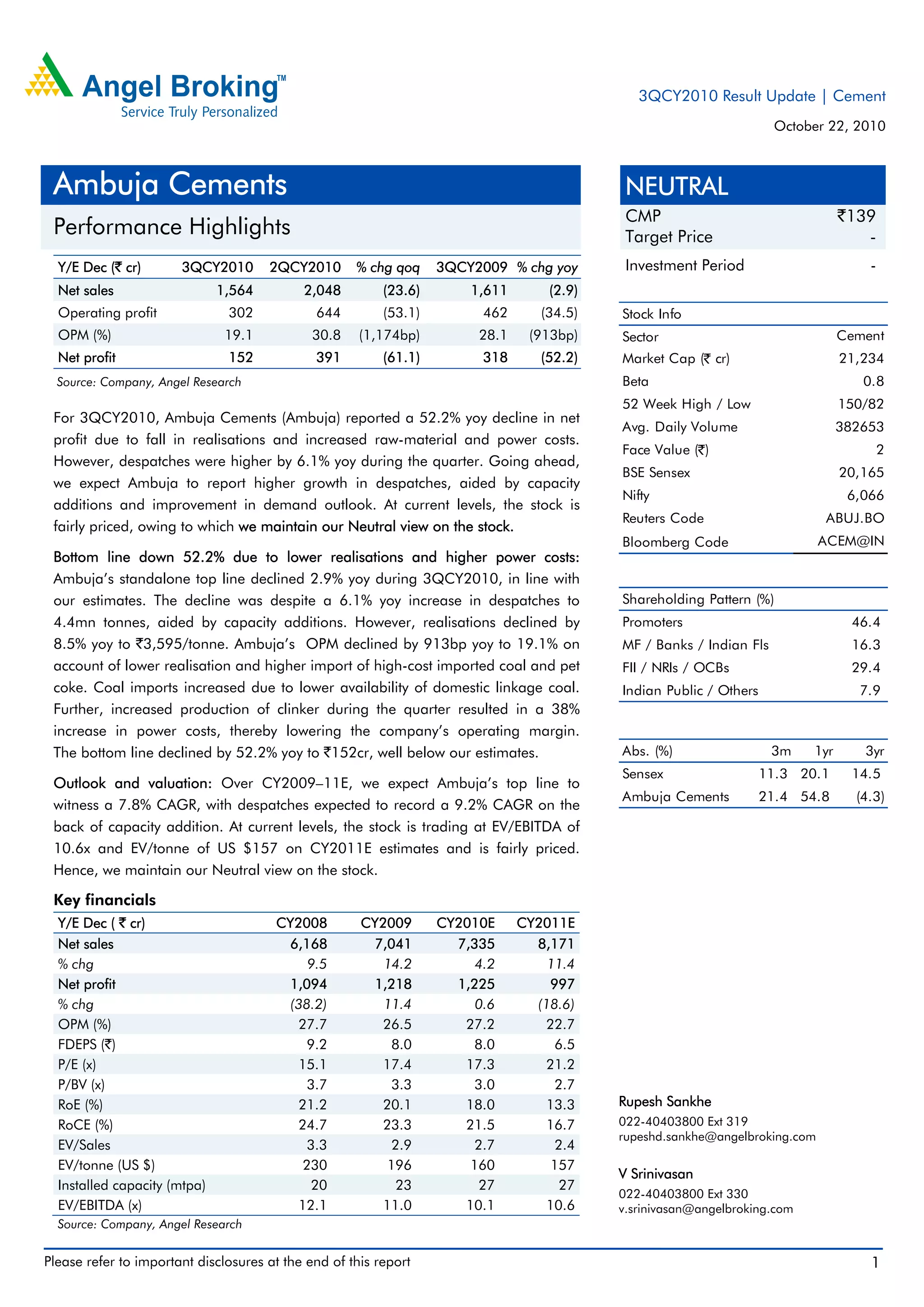

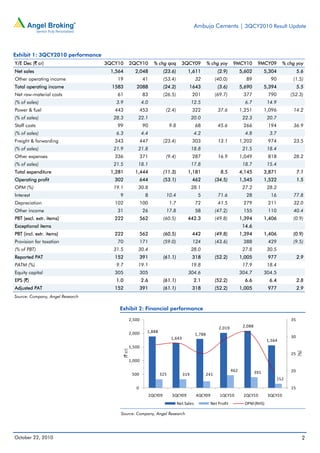

Ambuja Cements reported a 52.2% year-over-year decline in net profit for the third quarter of 2010 due to lower sales realizations and higher raw material and power costs. However, despatches increased 6.1% year-over-year. Going forward, analysts expect capacity additions to drive higher despatch growth and margins to improve as new clinker capacities eliminate external purchases. While third quarter results were below estimates, the stock is considered fairly priced at current levels based on estimated growth and margins over the next two years.