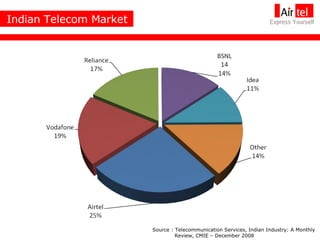

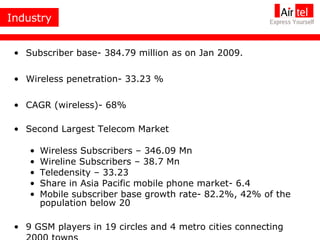

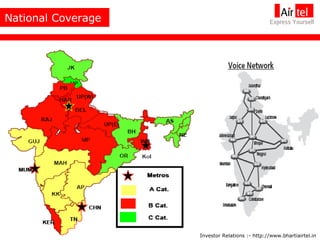

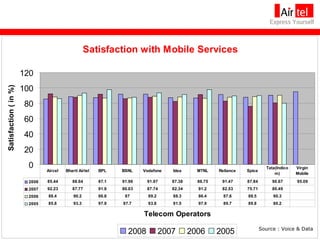

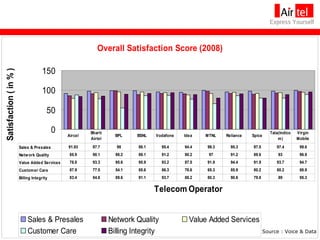

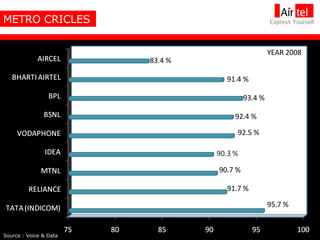

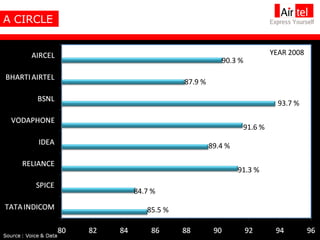

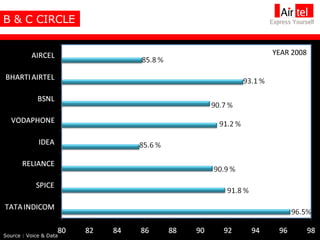

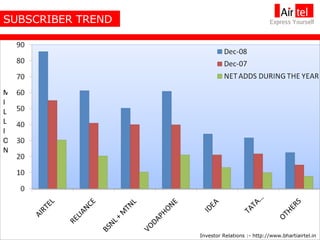

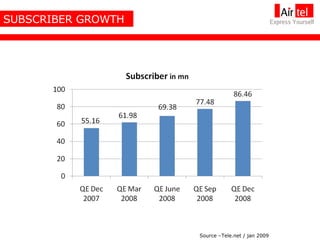

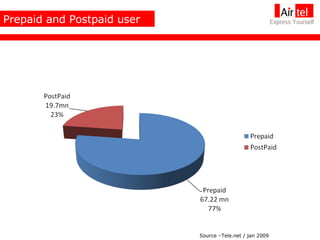

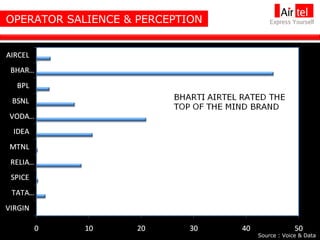

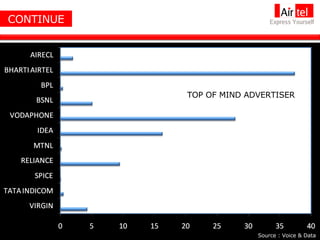

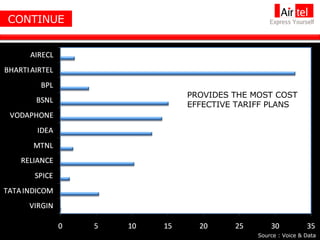

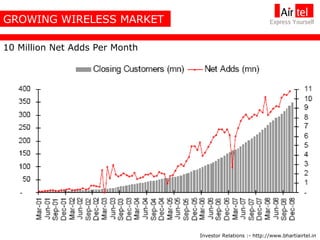

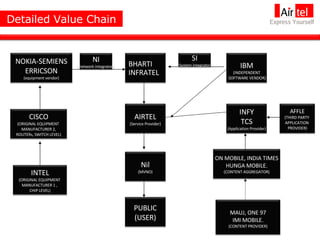

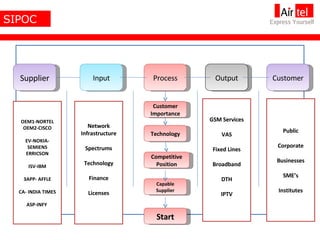

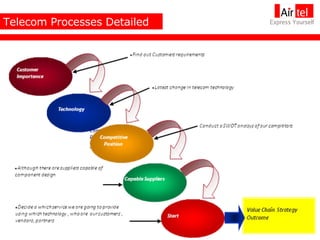

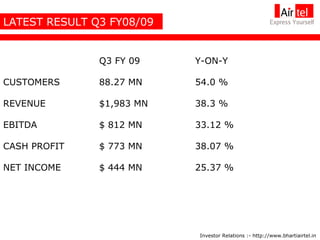

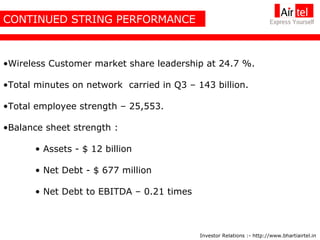

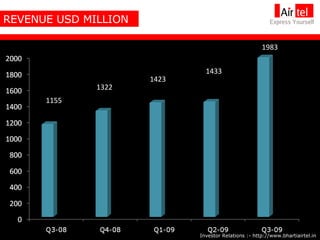

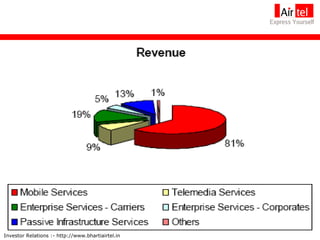

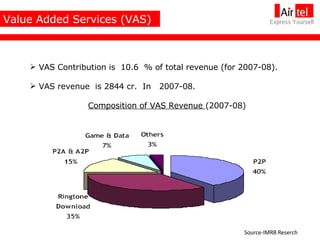

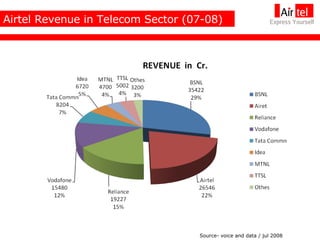

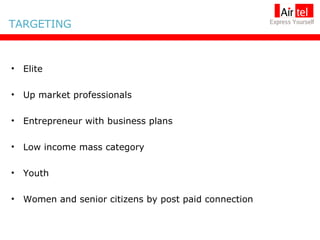

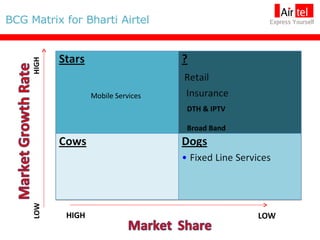

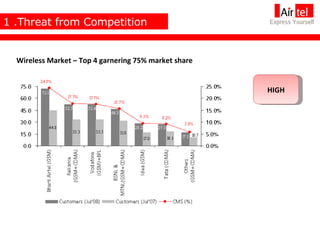

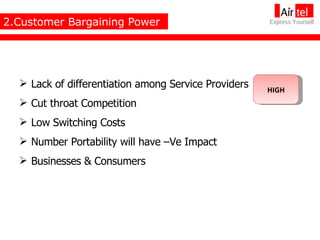

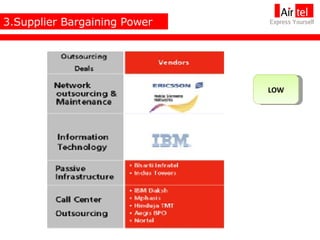

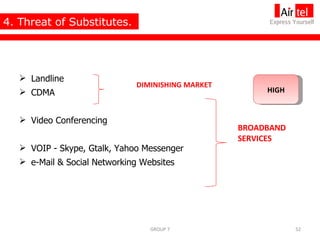

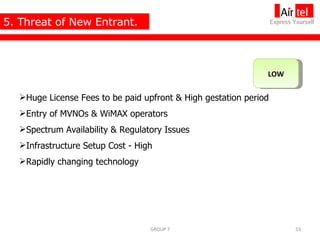

This document provides a summary of the Indian telecom industry and Bharti Airtel, the largest telecom company in India. It discusses Airtel's subscriber growth, value chain, financial analysis, marketing strategies, Porter's generic strategy, BCG matrix, five forces model, and SWOT analysis. Key information about Airtel includes over 88 million subscribers, operations in 23 circles, and revenue of $1.983 billion in Q3 FY09. The telecom industry in India has high competition and customer bargaining power.