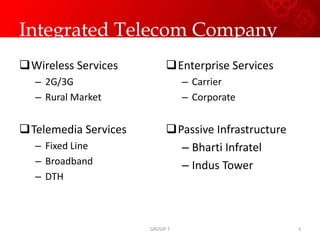

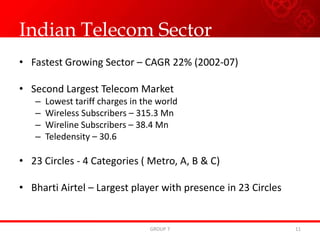

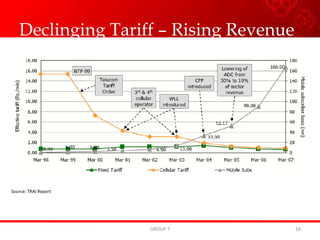

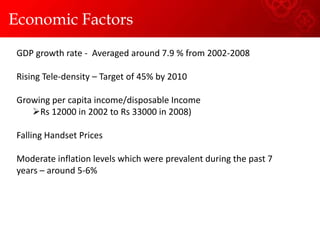

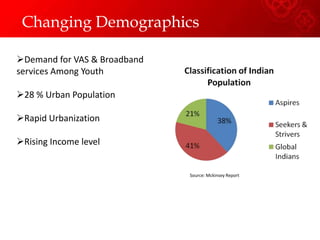

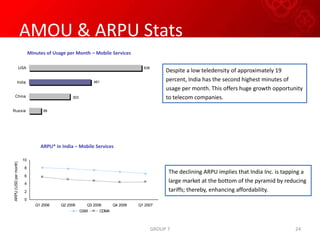

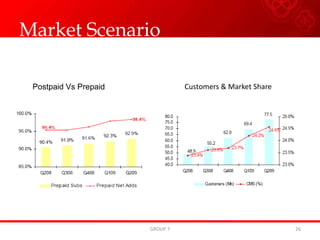

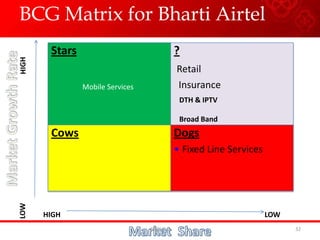

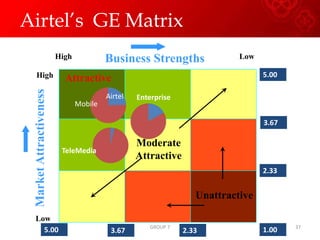

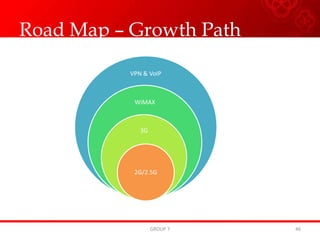

1) Bharti Airtel is the largest private telecom company in India and the third largest wireless operator in the world. It offers 2G, 3G, and other telecom services across India.

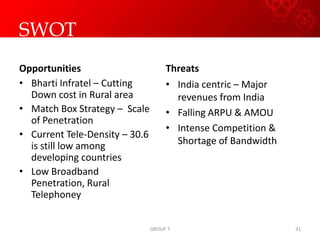

2) The company aims to become India's finest business conglomerate by 2020 through strategic acquisitions and diversification into related sectors like agriculture, financial services, and retail.

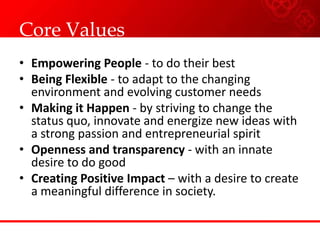

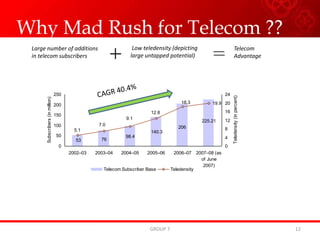

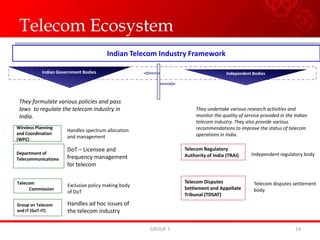

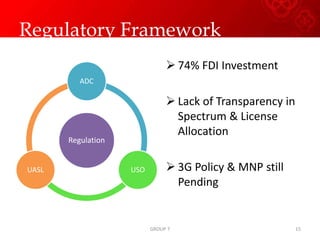

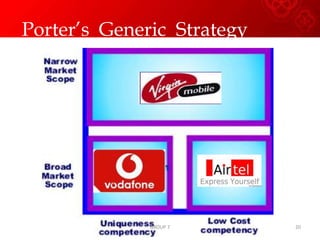

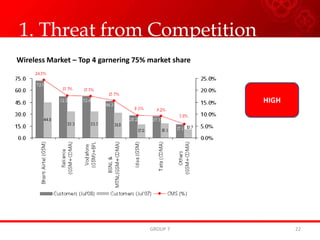

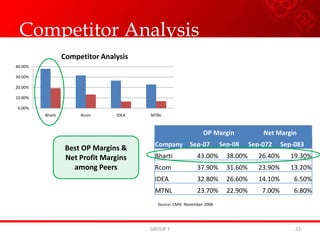

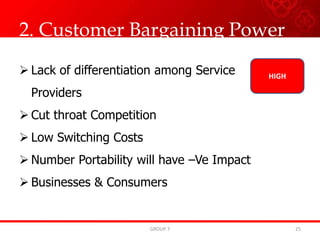

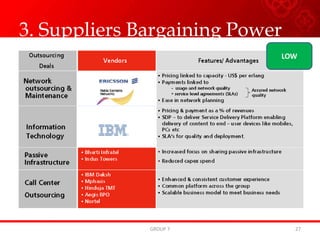

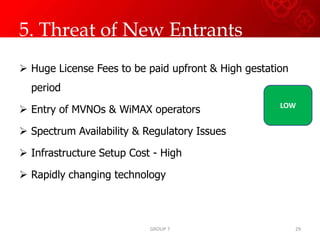

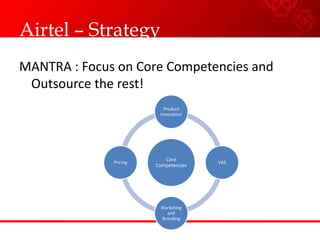

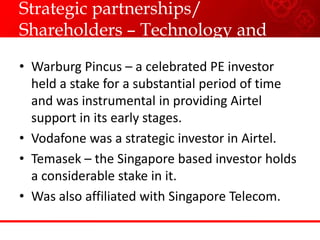

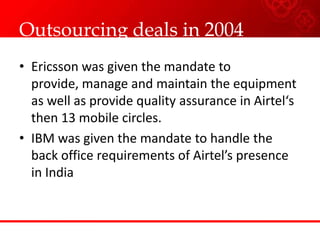

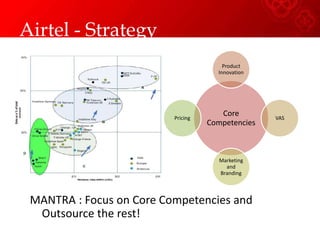

3) Bharti Airtel has a strong market position in India's rapidly growing telecom sector but faces high competition and regulatory challenges. It employs a strategy of strategic partnerships, outsourcing, and a focus on customer experience to maintain its leadership position.