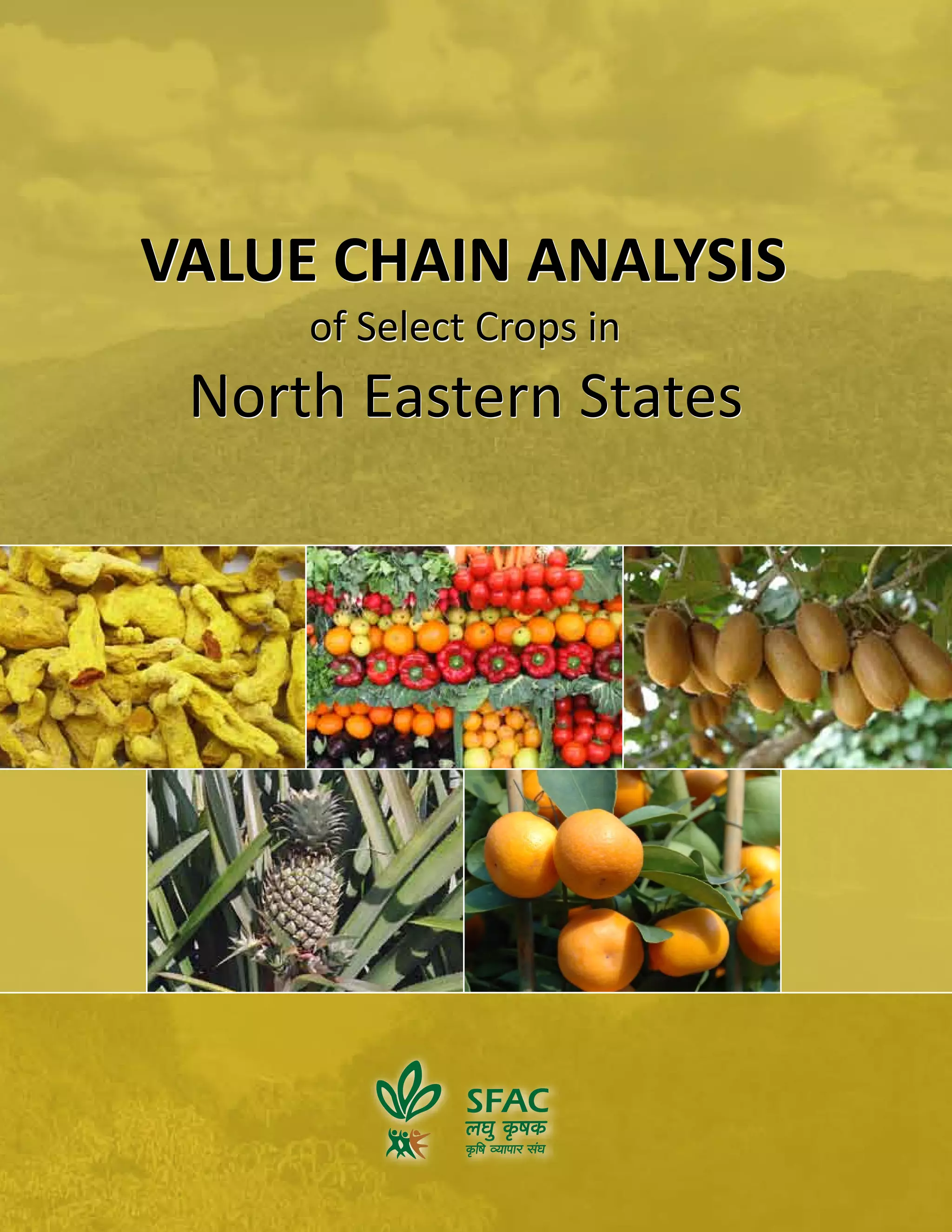

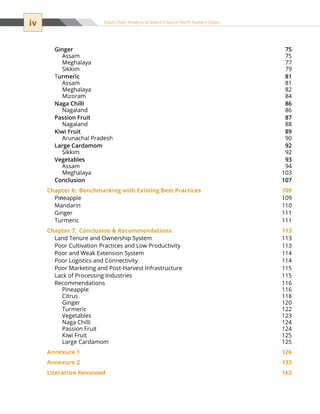

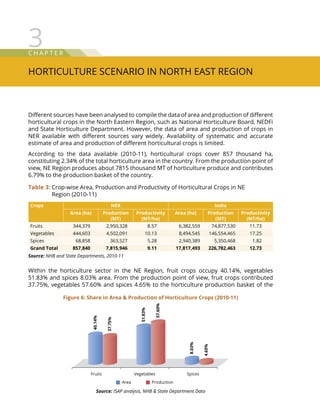

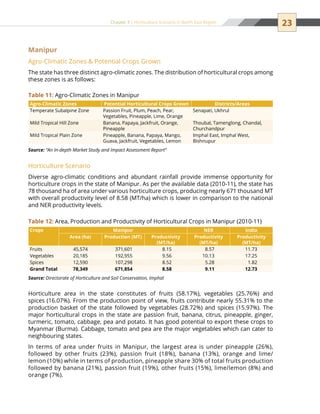

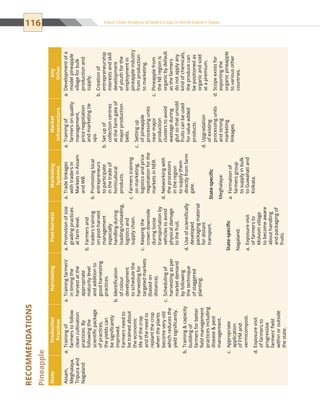

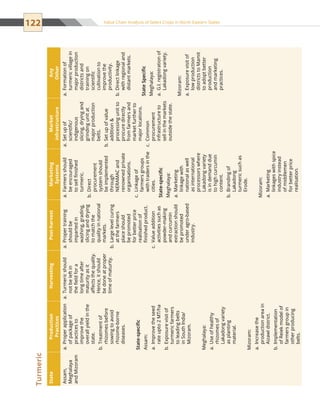

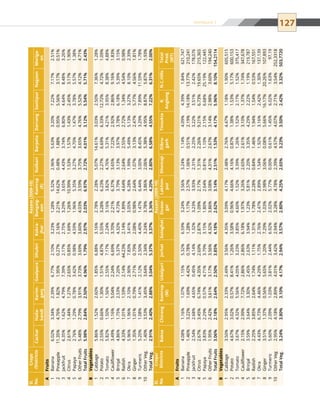

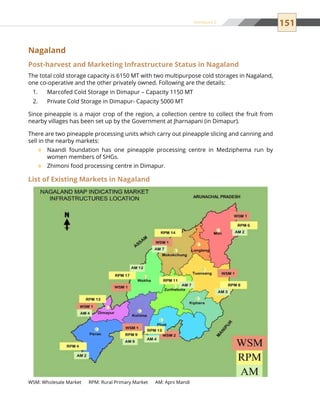

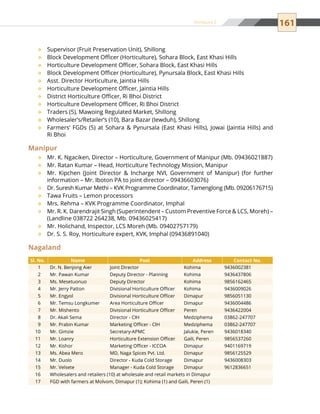

This document provides an overview and methodology for a value chain analysis study of select horticultural crops in the North Eastern region of India. The study aims to map the value chains of six focus crop groups - ginger/turmeric, citrus, pineapple, Naga chilli, vegetables, and other location-specific crops. Both secondary and primary research was conducted, including literature reviews, focus group discussions with farmers and traders, and interviews with stakeholders. The methodology involved identifying production clusters, mapping the movement of crops and price changes from farm to market, and analyzing challenges and opportunities to develop recommendations for strengthening the value chains.