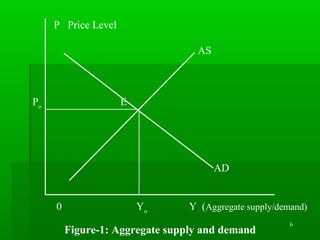

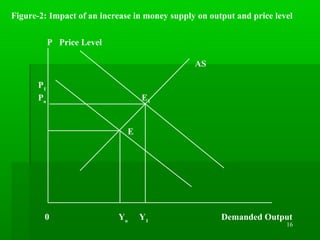

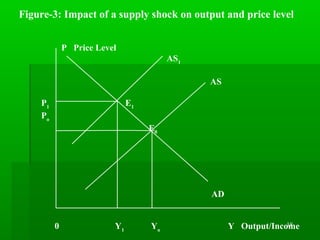

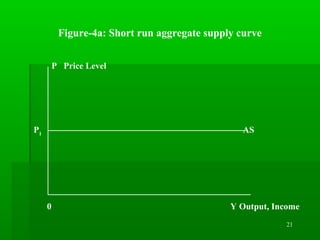

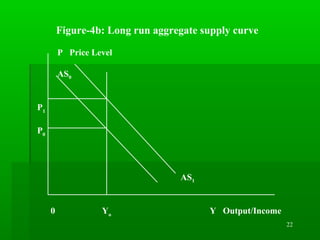

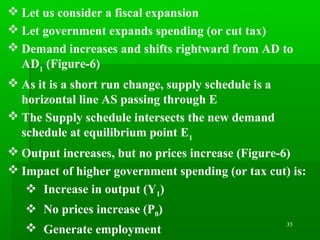

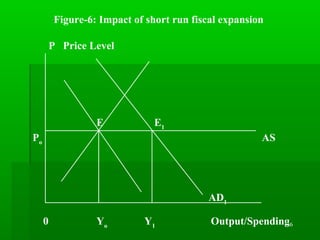

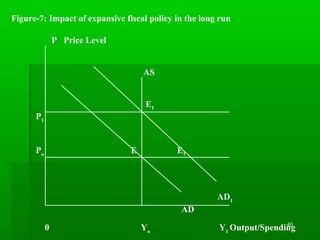

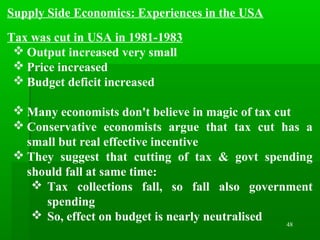

This document discusses aggregate supply and demand models. It explains that aggregate supply curves represent the quantity of output firms are willing to supply at different price levels. Aggregate demand curves show the equilibrium of goods and money markets at different price levels and output. The intersection of the aggregate supply and demand curves determines equilibrium output and price. Fiscal and monetary policies can shift these curves, impacting output and inflation. Expansionary fiscal policy like tax cuts shifts aggregate demand right, increasing output in the short run but raising prices in the long run when supply is fixed.