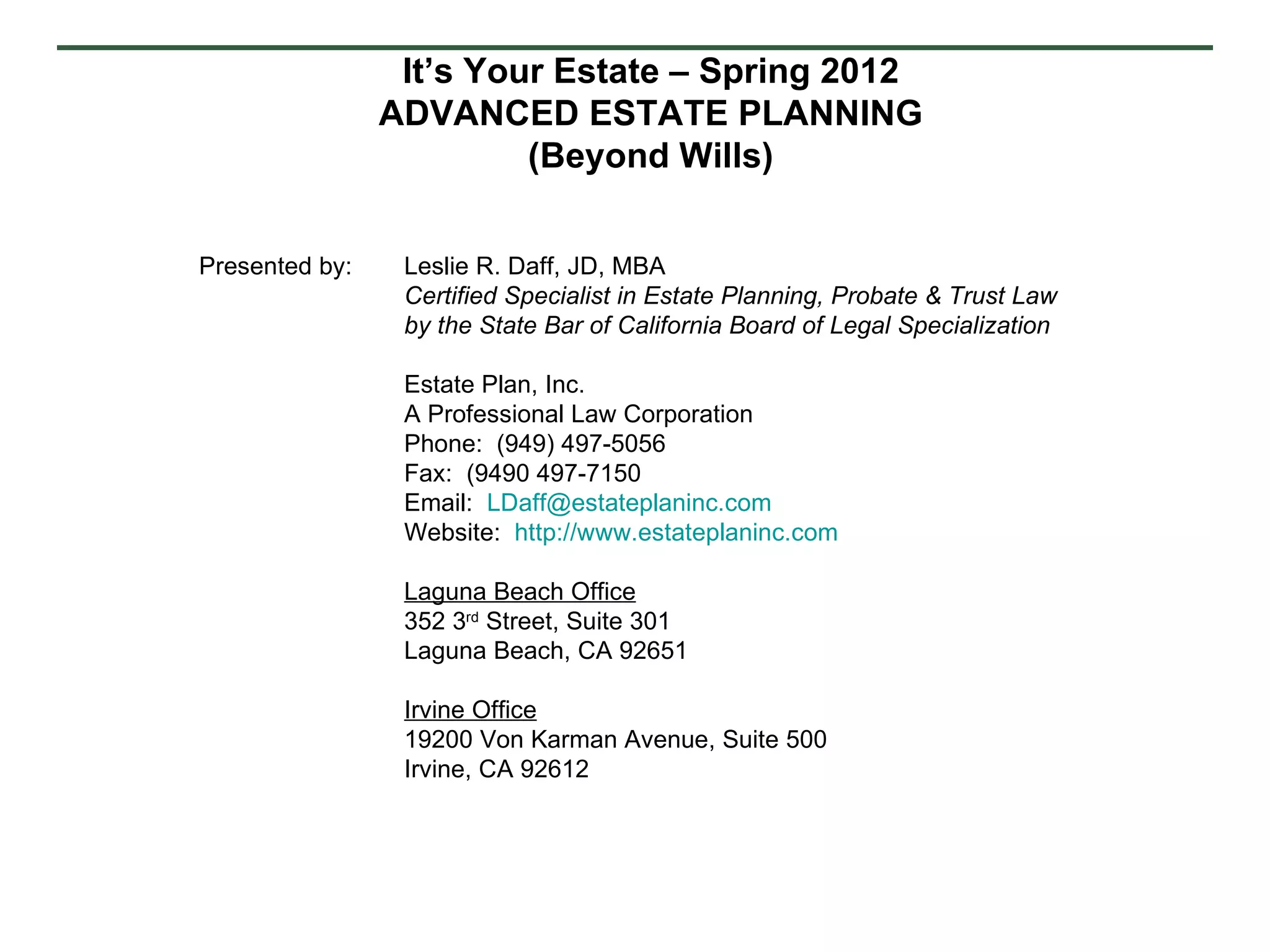

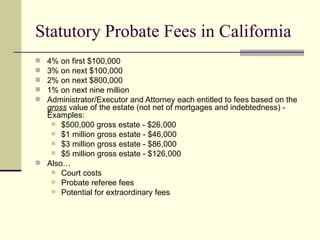

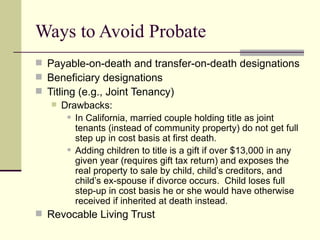

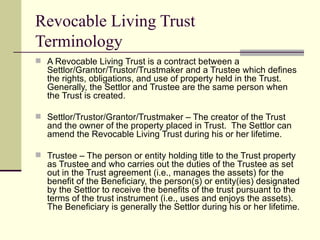

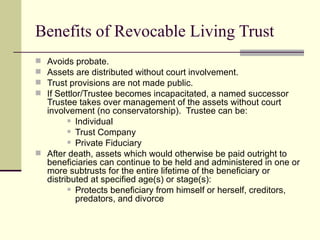

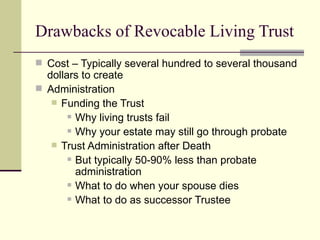

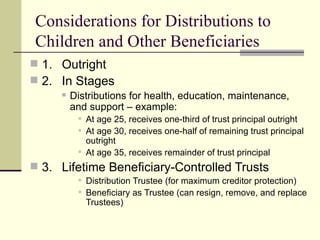

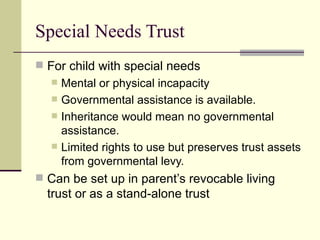

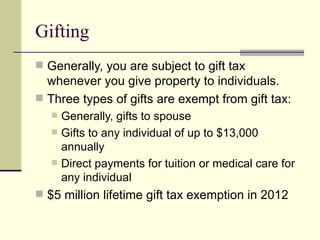

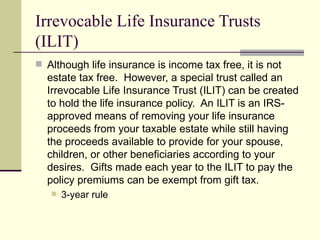

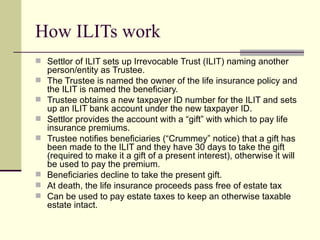

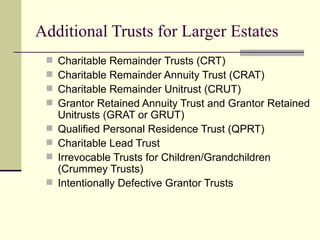

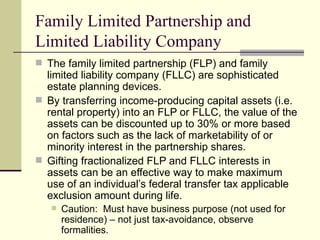

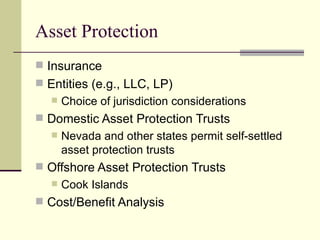

The document presents advanced estate planning strategies beyond traditional wills, focusing on various types of trusts, including revocable and irrevocable trusts, to avoid probate and manage assets effectively. It outlines the costs associated with probate in California, ways to avoid these fees, and benefits of utilizing living trusts, such as avoiding court involvement and privacy in asset distribution. Additionally, the document discusses tax implications, various trust types for special situations, and strategies for gifting and asset protection.