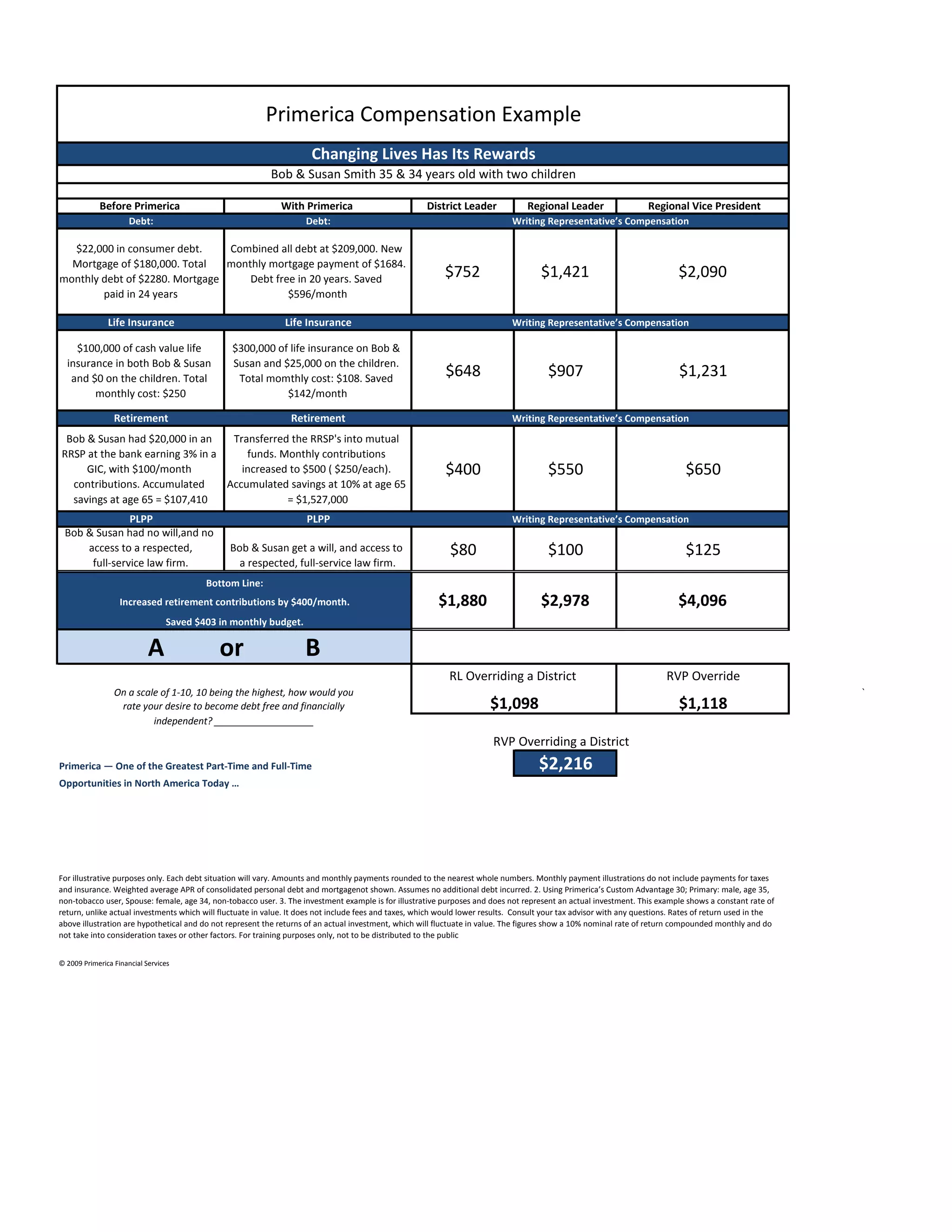

The document outlines the financial journey of Bob and Susan Smith, detailing their debts and the improvements made after engaging with Primerica, including becoming debt-free in 20 years and increasing their retirement contributions. It highlights their life insurance investments and savings growth through mutual funds. The information is illustrative and emphasizes that actual investment returns may vary.