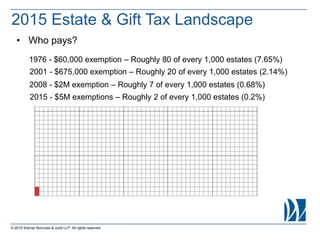

The document discusses the 2015 estate and gift tax landscape including:

- The federal estate tax exemption was $5.43 million per individual or $10.86 million for married couples.

- Only the portion of an estate over the exemption is taxed, with an example showing a $7.8 million estate with $2.37 million taxed after exemptions.

- Portability allows a surviving spouse to make use of the deceased spouse's unused exemption, simplifying planning for many estates. However, it has some disadvantages like lack of asset protection and loss of discounts.

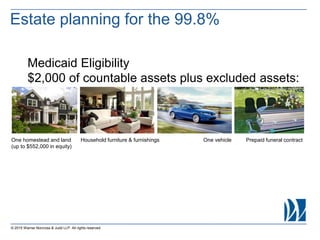

- Proper estate planning techniques can help address long-term care needs, property tax issues, and transferring property to heirs.