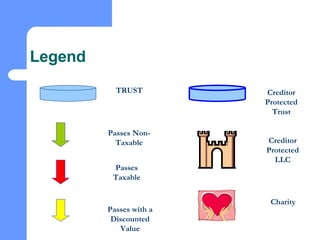

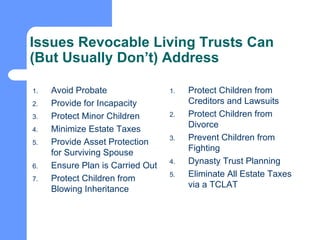

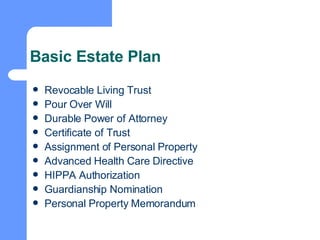

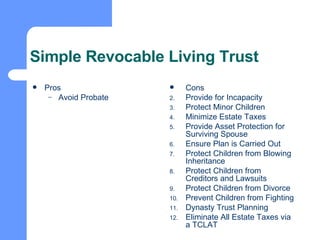

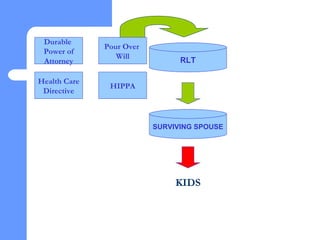

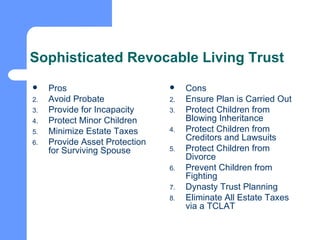

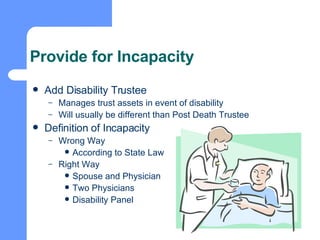

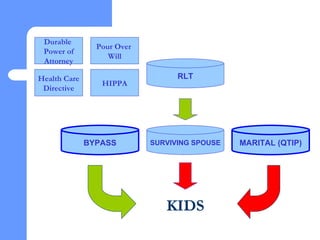

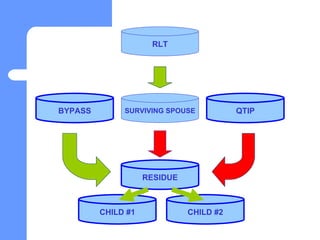

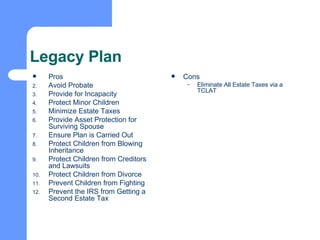

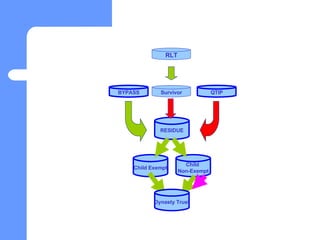

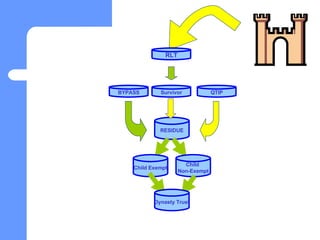

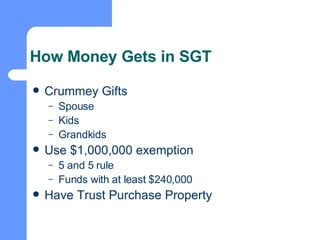

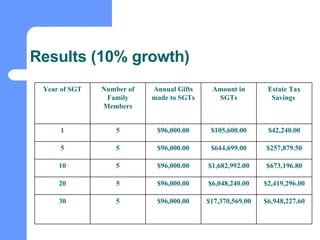

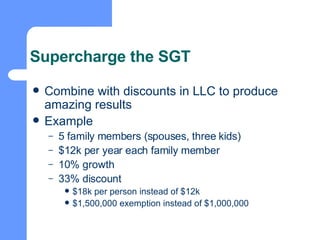

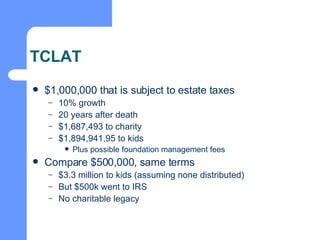

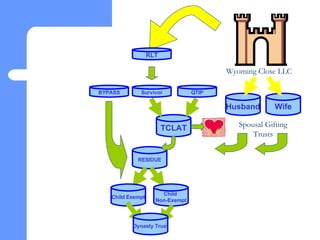

The document outlines advanced estate planning strategies for advisors, including various trusts such as revocable living trusts, dynasty trusts, and spousal gifting trusts, aimed at minimizing estate taxes, avoiding probate, and protecting assets from creditors. It emphasizes the importance of thorough planning, incorporating tools like life insurance and LLCs for additional asset protection and tax efficiency. Various tips for advisors are included throughout to enhance client discussions about financial planning and asset distribution after death.