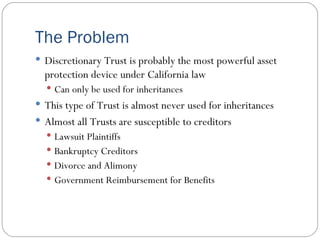

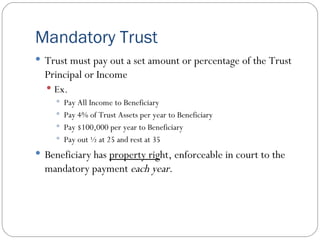

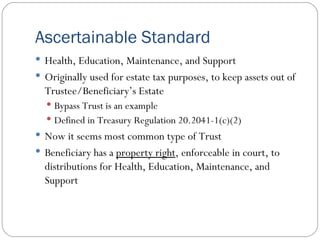

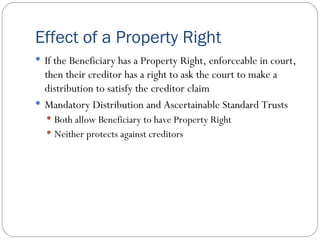

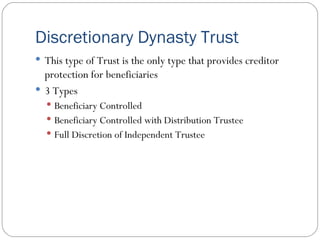

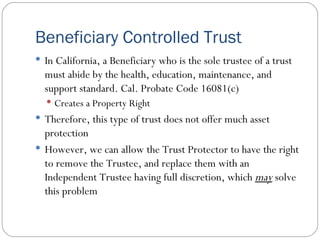

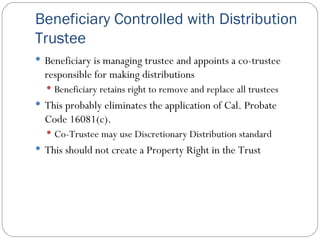

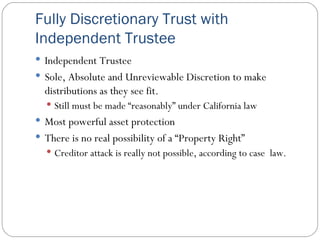

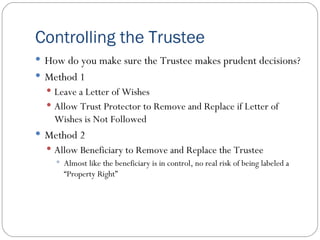

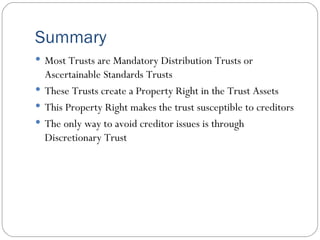

The document discusses the use of discretionary trusts as a powerful asset protection tool under California law for inheritances, which are typically vulnerable to creditors. Various types of trusts are compared, highlighting that mandatory distribution and ascertainable standard trusts create enforceable property rights that can be claimed by creditors, while discretionary trusts provide stronger protection. The document emphasizes the importance of proper trustee management to enhance asset protection against creditor claims.

![Protecting Inheritances from Creditors By Ward J. Wilsey, JD, LLM 3655 Nobel Dr. Suite 345 San Diego, CA 92122 (858) 764-2672 [email_address]](https://image.slidesharecdn.com/protectinginheritances-090305152009-phpapp01/75/Protecting-Inheritances-1-2048.jpg)