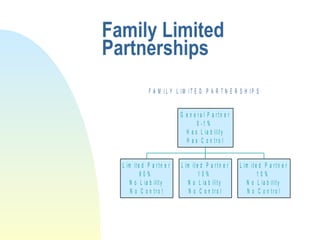

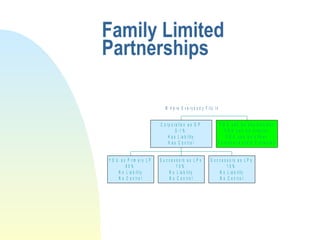

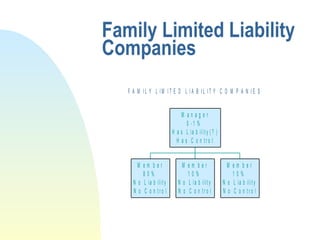

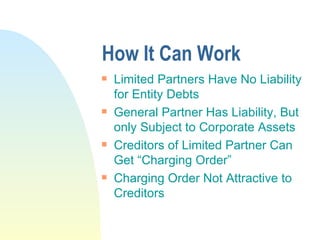

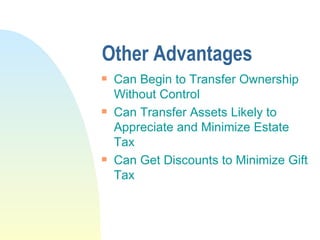

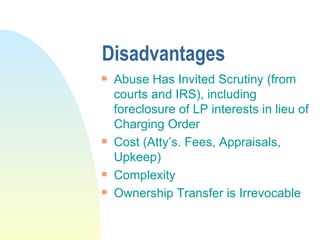

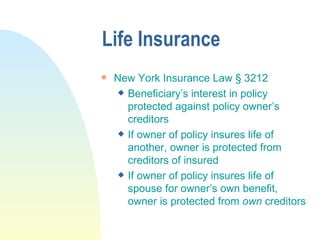

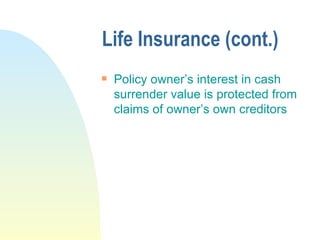

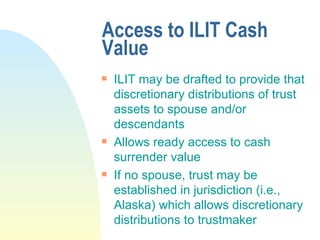

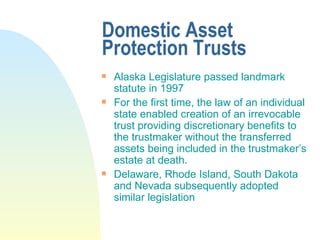

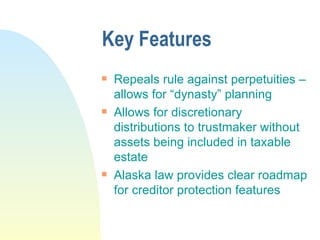

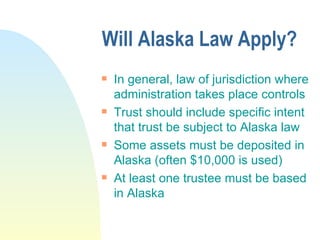

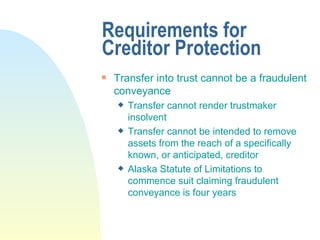

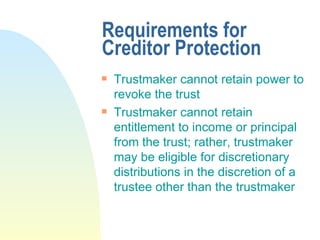

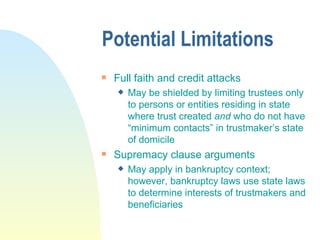

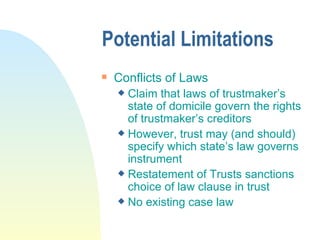

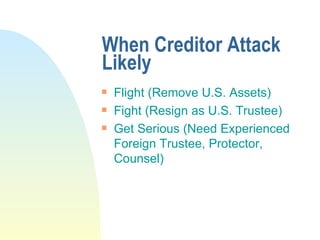

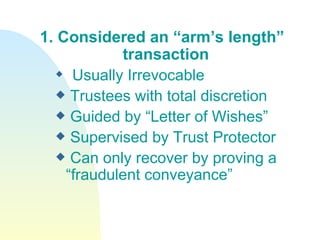

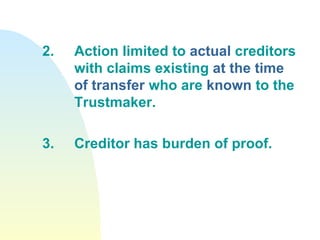

The document outlines asset protection strategies, emphasizing that it involves making assets difficult for creditors to access without being fraudulent or tax evasive. It discusses effective methods such as family limited partnerships, life insurance trusts, and domestic asset protection trusts, highlighting the legal frameworks that support these strategies. Additionally, it mentions offshore asset protection trusts, which require careful planning and may involve complexities and costs.