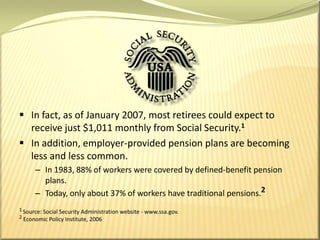

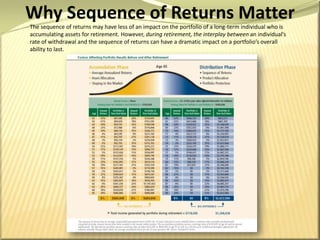

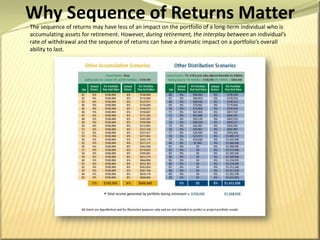

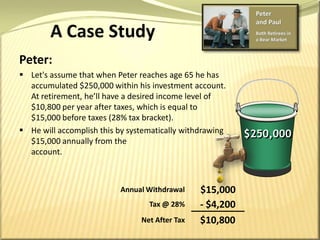

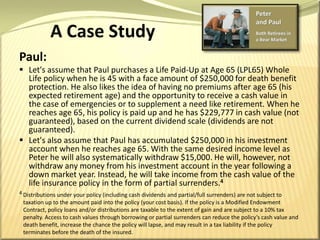

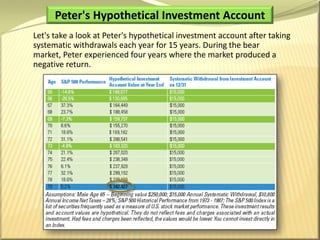

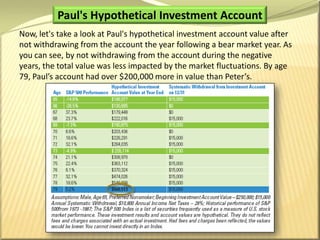

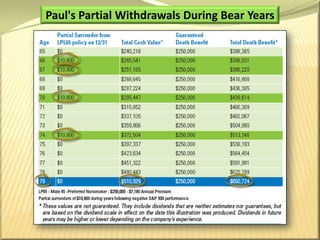

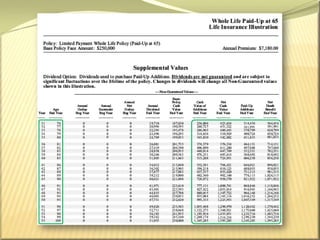

Traditional means of funding retirement like pensions and Social Security are becoming less reliable. Most retirees can expect about $1,000 monthly from Social Security alone. Many retirees rely on investment accounts to supplement retirement income, but bear markets can significantly impact account values, especially if withdrawals are taken during downturns. Purchasing a permanent life insurance policy provides a death benefit for beneficiaries and cash value that can be accessed during bear markets to avoid depleting investment accounts through withdrawals during downturns. This strategy helped one retiree's investment account balance remain over $200,000 higher by age 79 compared to withdrawing during bear years.