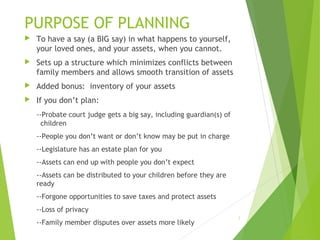

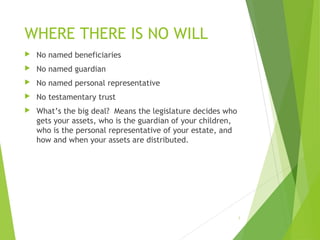

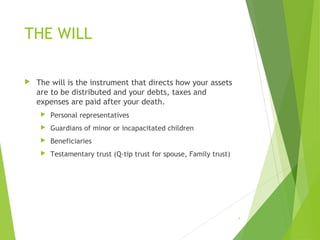

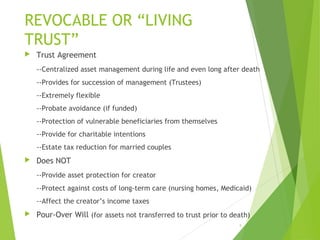

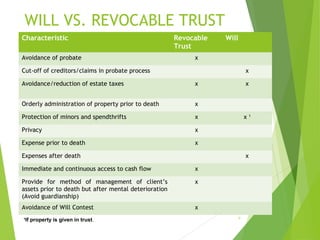

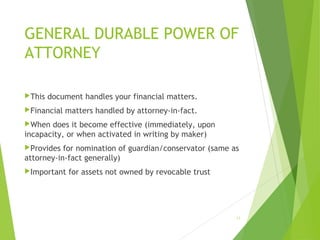

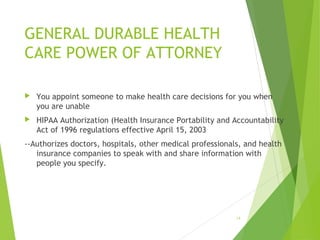

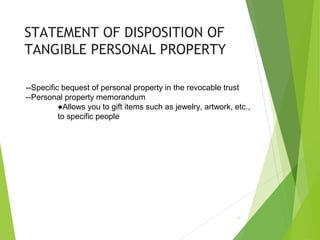

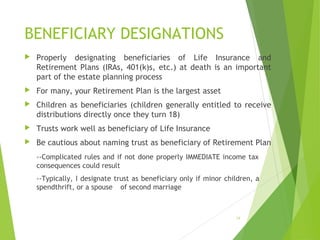

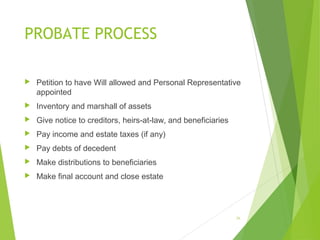

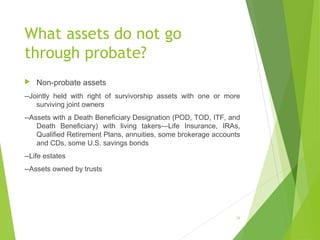

The document is an overview of estate planning, stressing its importance for everyone to dictate the distribution of their assets and ensure guardianship for minors. It outlines key components of an estate plan, such as wills, trusts, and powers of attorney, while highlighting the potential consequences of not having a plan. The information also covers probate processes and tax considerations related to estate planning.