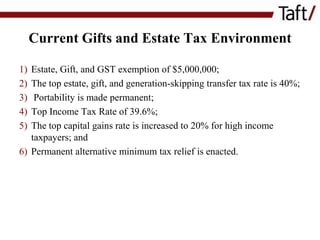

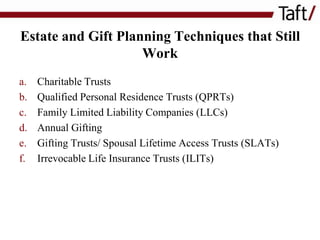

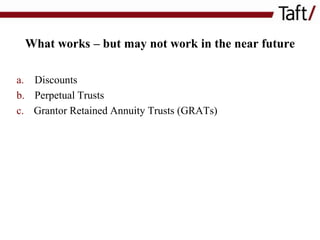

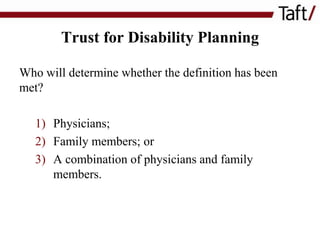

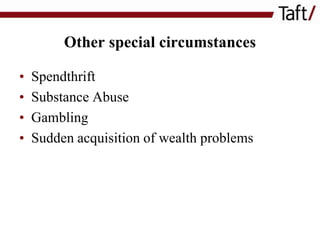

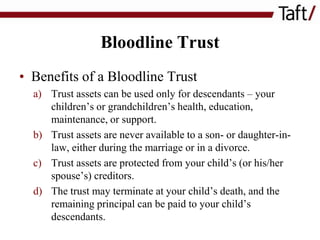

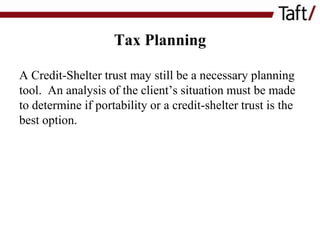

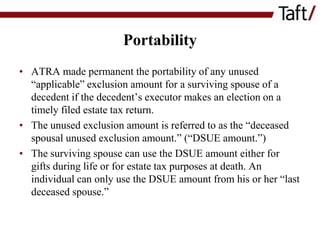

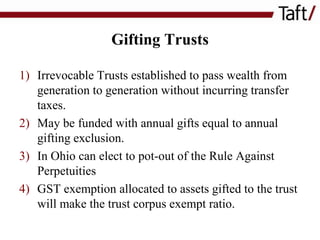

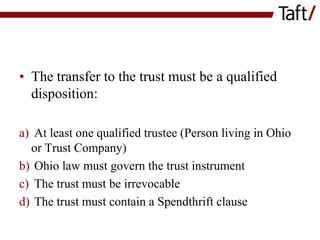

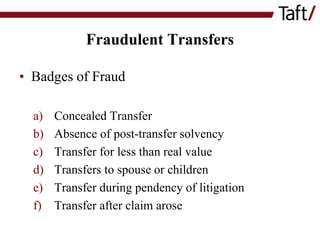

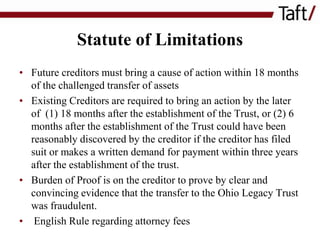

This document discusses current estate planning techniques and issues. It notes that the estate and gift tax exemption is now $5 million per person and portability has been made permanent. It then reviews various estate planning tools that still work well like charitable trusts, QPRTs, family LLCs and annual gifting. It also discusses reasons for estate planning besides taxes, such as probate avoidance. Specific trust types are explained for purposes of disability, distribution of assets, and protecting against substance abuse. Spousal lifetime access trusts and legacy trusts are discussed as ways to leverage exemptions and protect assets.