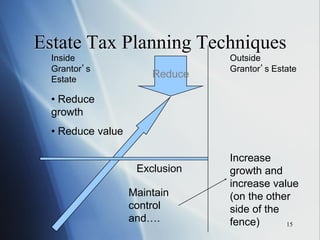

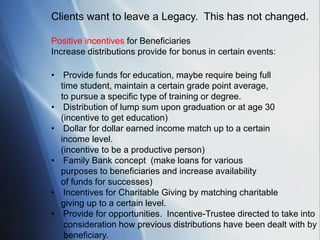

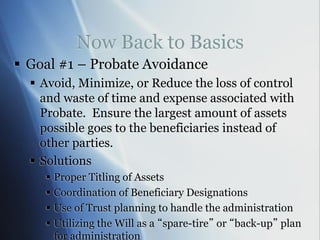

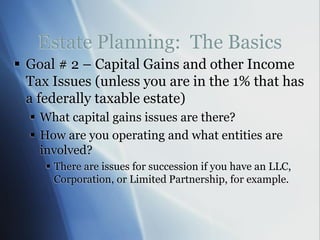

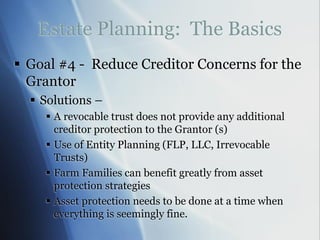

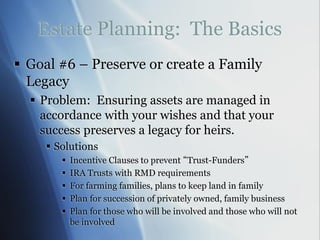

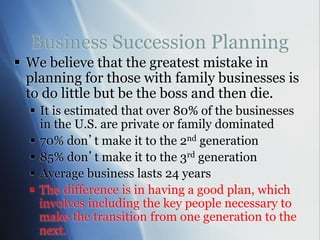

This document summarizes a presentation on estate planning for farm families given at a women managing the farm conference. It discusses how estate planning laws and strategies have changed significantly in recent years due to increases in the federal estate and gift tax exemption thresholds. Specifically, it notes that with the current thresholds, over 99% of Americans do not need to worry about estate or gift taxes. As a result, the focus of estate planning has shifted from tax avoidance to non-tax related goals like retirement planning, incapacity planning, and facilitating intergenerational transfer of assets. It also discusses strategies for addressing income tax issues like capital gains tax on assets with low cost basis.