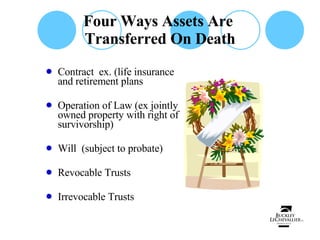

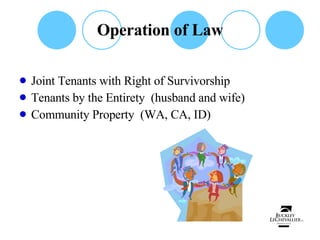

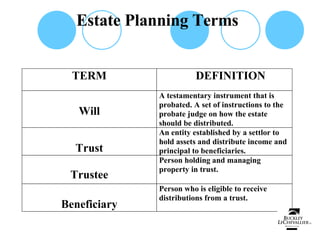

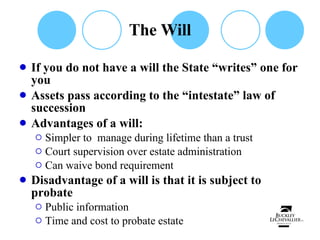

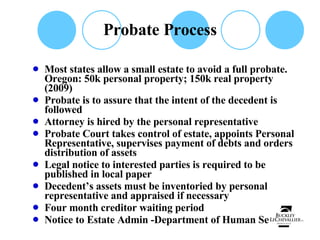

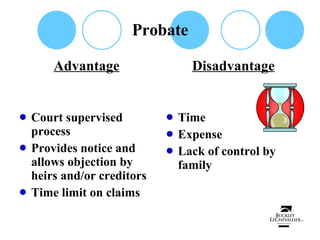

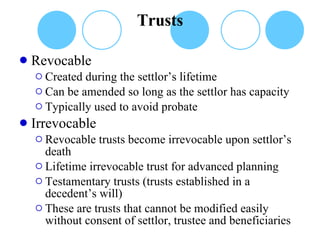

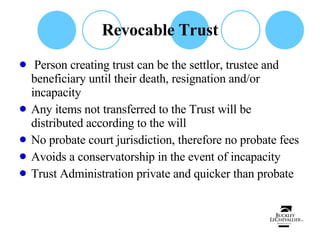

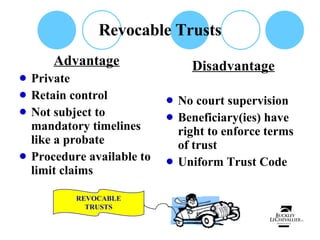

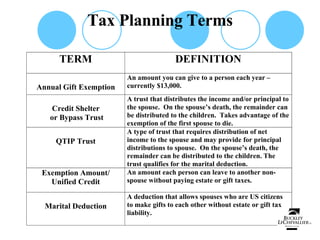

Estate planning involves transferring assets upon death in ways that provide for family and minimize taxes. The document discusses various estate planning tools like wills, trusts, and beneficiary designations that allow assets to pass outside of probate. It also covers important concepts like probate, taxes, updating plans, and choosing trustees and beneficiaries. Estate planning ensures one's wishes are followed and assets are distributed efficiently upon death.