1. This document discusses key accounting concepts and principles such as business entity, historical cost, consistency, and accruals/matching.

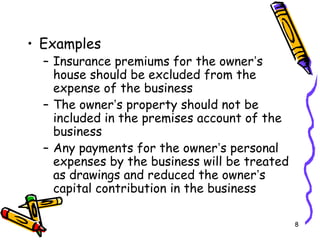

2. Some core concepts discussed include treating the business and its owners as separate entities, recording transactions in monetary terms, and preparing financial statements on the assumption the business will continue operating.

3. Important principles that modify accounting practices are also outlined, such as recognizing revenues and expenses according to when they are earned/incurred rather than when cash is paid/received, using prudence to avoid overstating profits, and providing relevant and objective information.