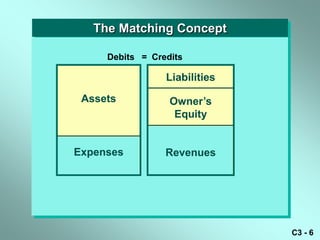

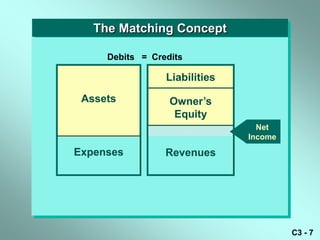

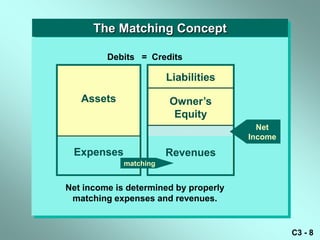

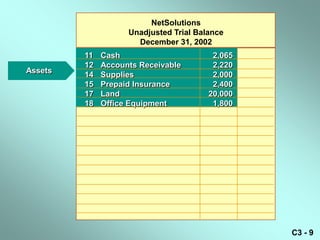

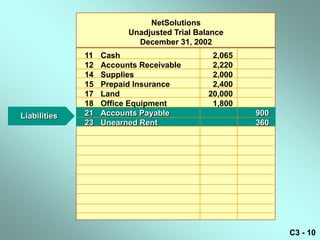

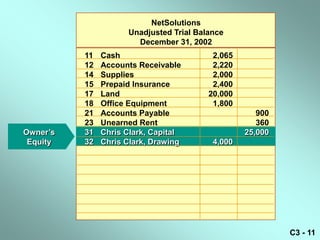

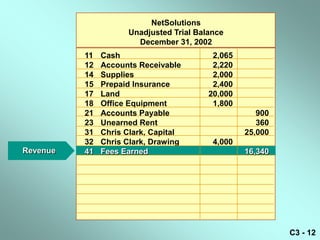

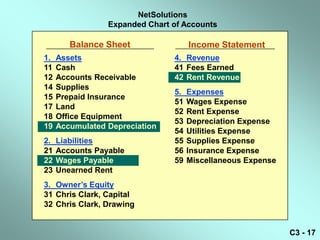

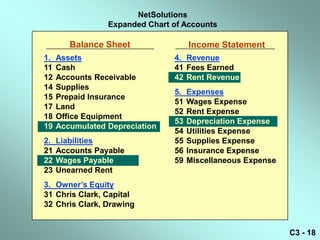

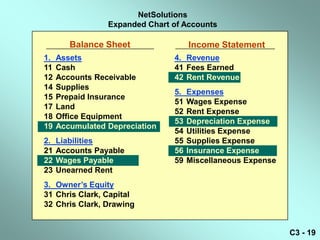

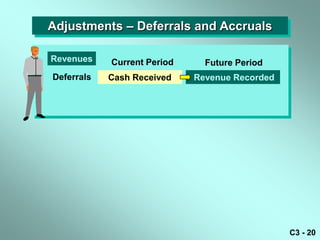

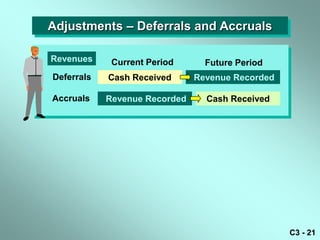

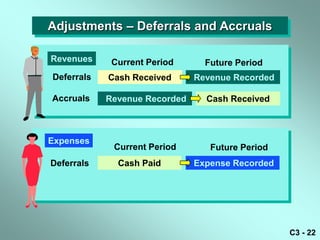

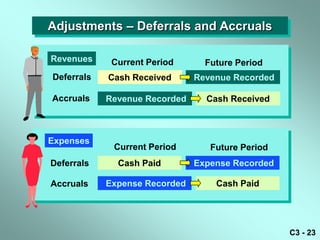

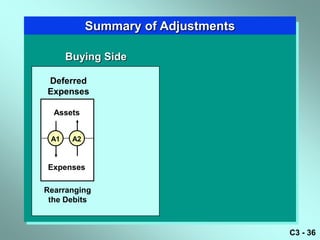

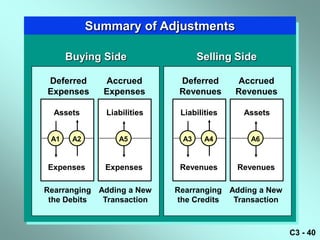

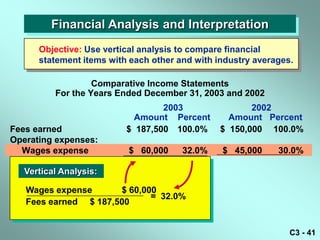

1) The document discusses the matching concept and adjusting process in accounting. It covers topics like deferrals, accruals, adjusting entries, and analyzing financial statements.

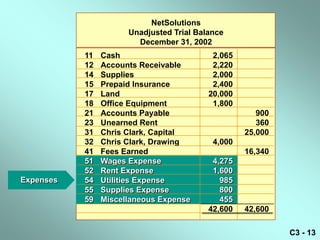

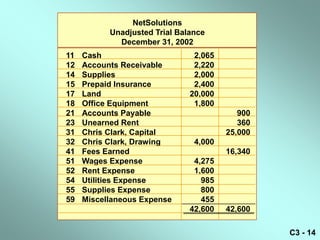

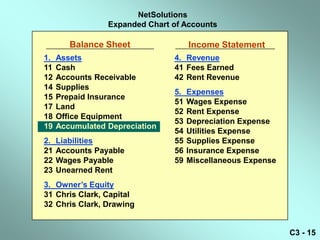

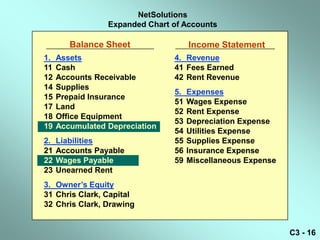

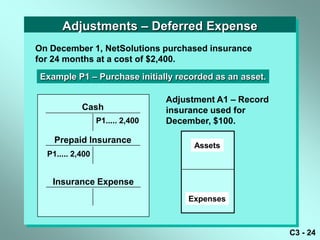

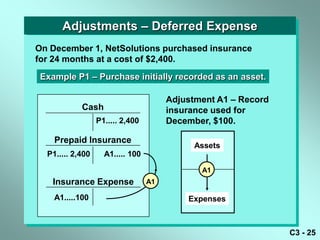

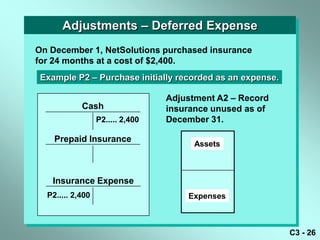

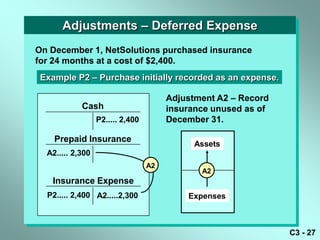

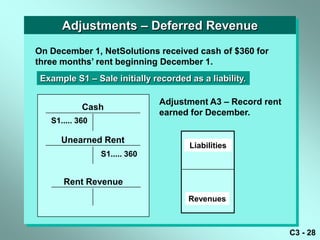

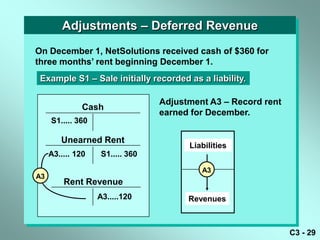

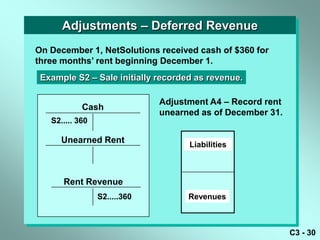

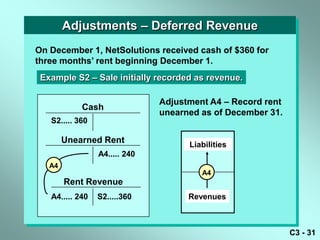

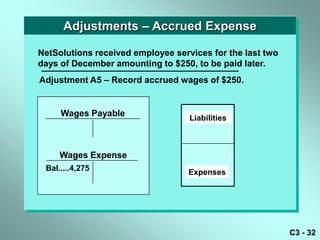

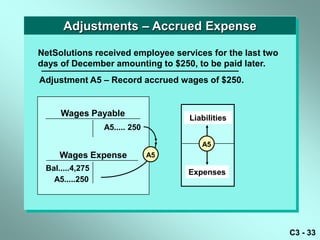

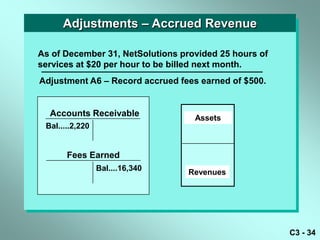

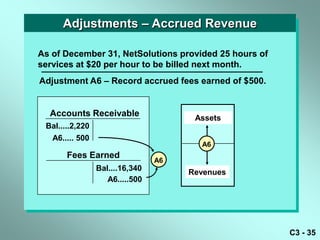

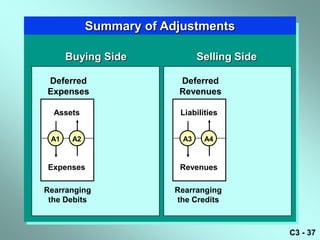

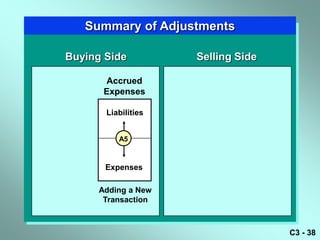

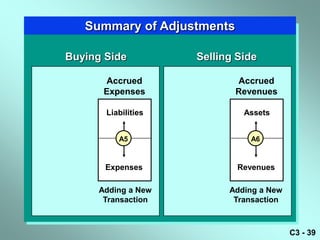

2) Examples are provided of adjusting entries for deferred expenses, deferred revenue, accrued expenses, and accrued revenue to properly match revenues and expenses between accounting periods.

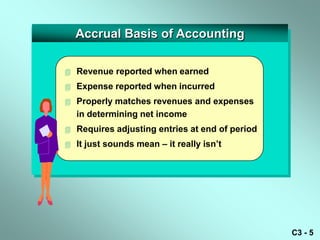

3) The goal of adjustments is to ensure revenues and expenses are recorded in the appropriate period according to the accrual basis of accounting.