The document discusses several key accounting concepts:

- The entity concept treats a business and its owners as separate entities for accounting purposes. Personal transactions are separate from business transactions.

- The periodicity concept requires that financial statements like the balance sheet and income statement be prepared at regular intervals, such as monthly or annually, to determine profit and assess financial position.

- The money measurement concept states that all business transactions must be recorded in terms of a country's currency, such as Malaysian ringgit. Non-monetary items are not accounted for.

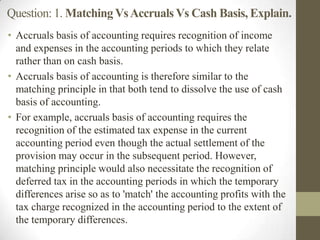

The document provides explanations of several other fundamental accounting concepts like going concern, matching, realization, accrual, consistency, historical cost, prudence, and materiality