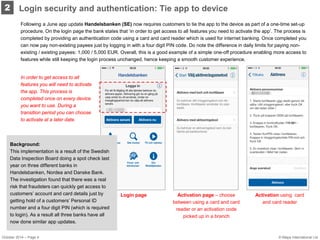

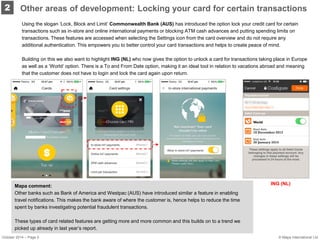

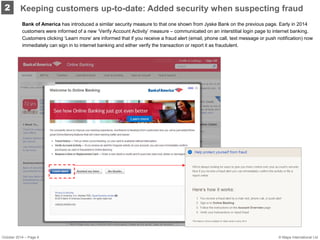

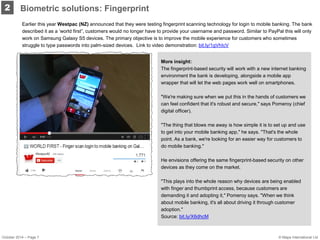

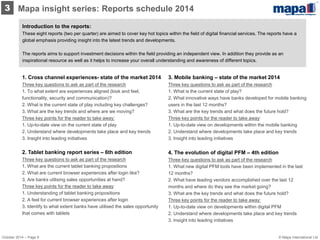

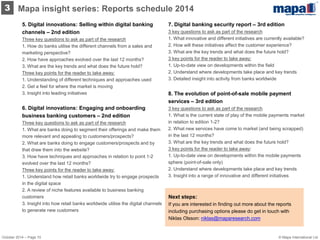

The document is a report by Mapa Research summarizing developments in digital banking security over the past 12 months. The report is divided into sections on login security and authentication, other development areas, keeping customers updated, and biometric solutions. It provides examples of innovative approaches from banks globally to improve security and the customer experience through mobile banking features and authentication methods.