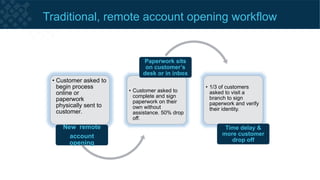

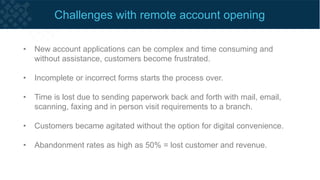

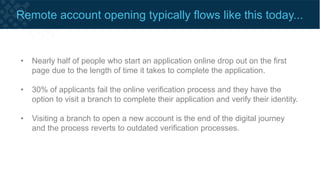

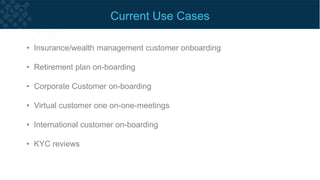

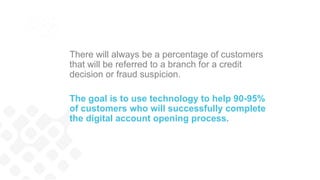

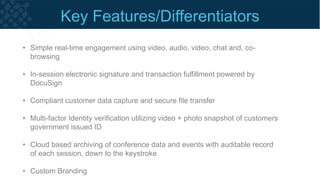

The document discusses the challenges of remote account opening, highlighting issues such as customer frustration, high abandonment rates, and the need for human assistance in complex transactions. It emphasizes the importance of a blended online and offline experience, utilizing technology like video conferencing and e-signature to reduce friction in the onboarding process. The goal is to enhance customer engagement and streamline the digital account opening for up to 90-95% of users while maintaining compliance and security.