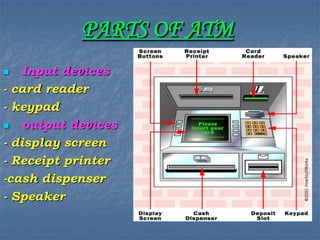

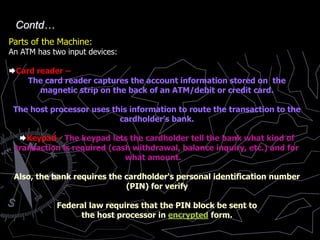

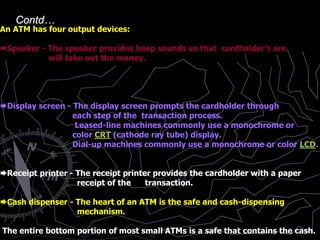

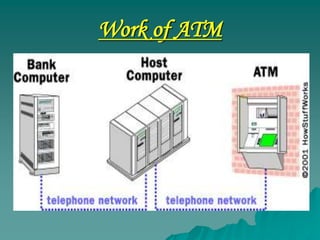

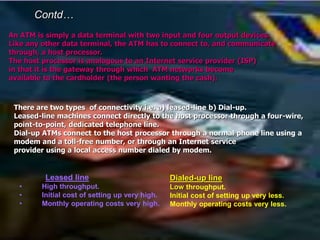

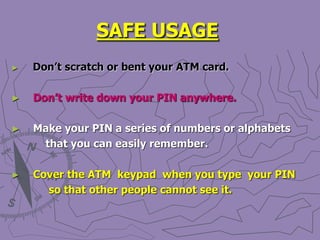

An ATM, or automated teller machine, allows customers to access their bank accounts to withdraw cash or check balances without a human bank teller. The presenter discussed the history, parts, safe usage, benefits, and services of ATMs. Key points included that the first ATM was installed in 1967 in London, ATMs have input devices like a card reader and keypad and output devices like a display screen and cash dispenser, and ATMs provide benefits to both customers and banks by offering convenience and additional revenue.