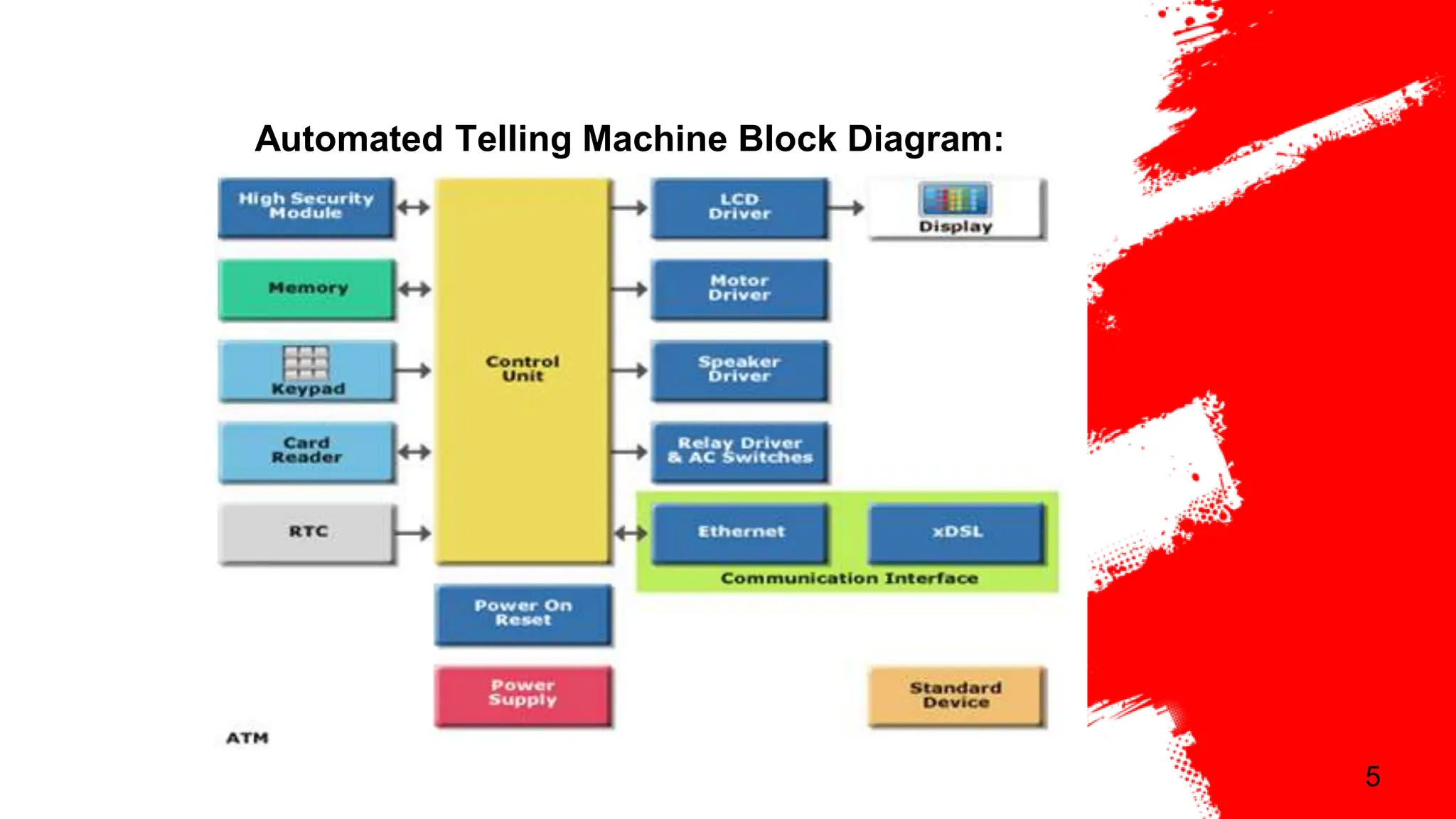

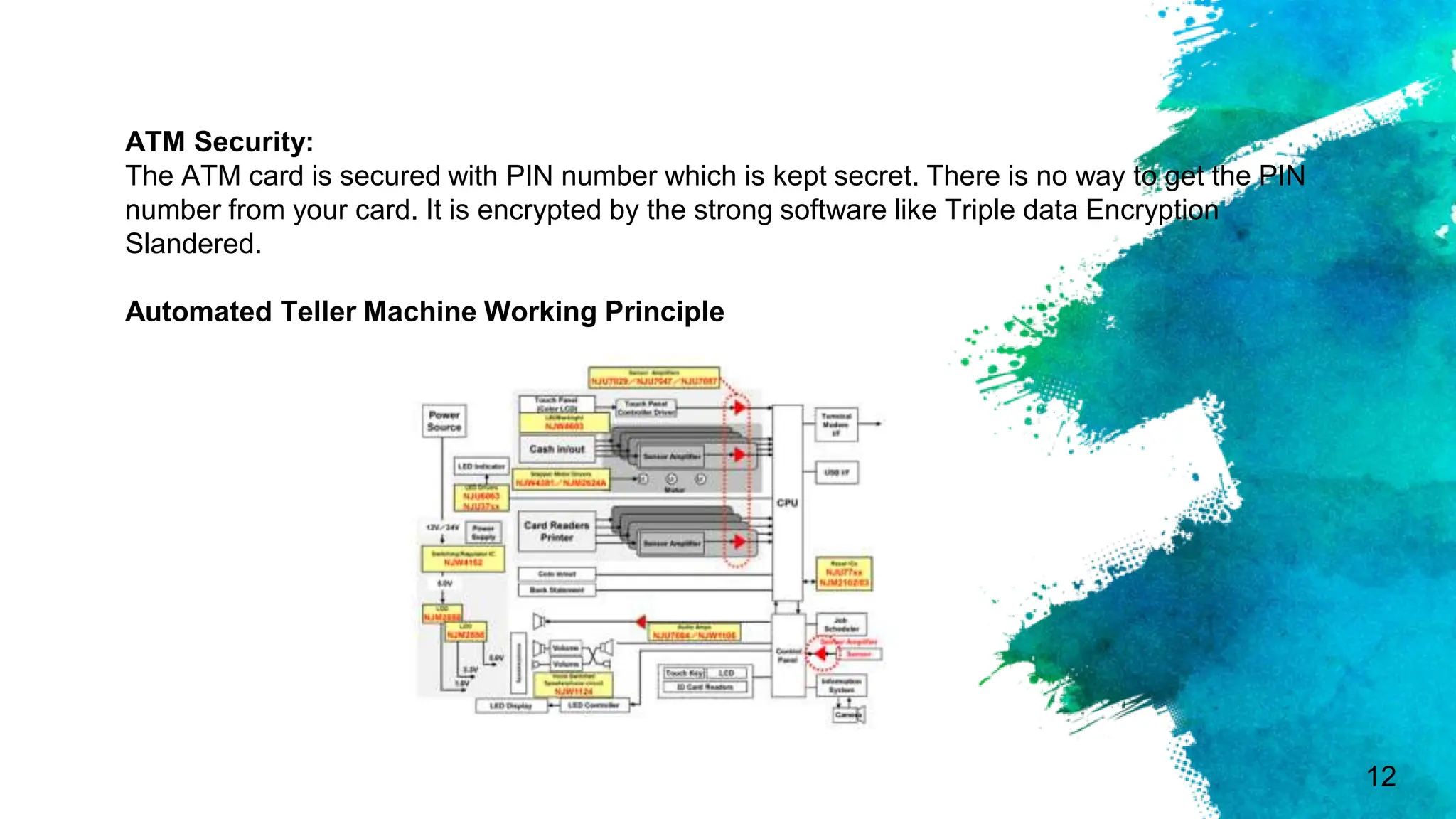

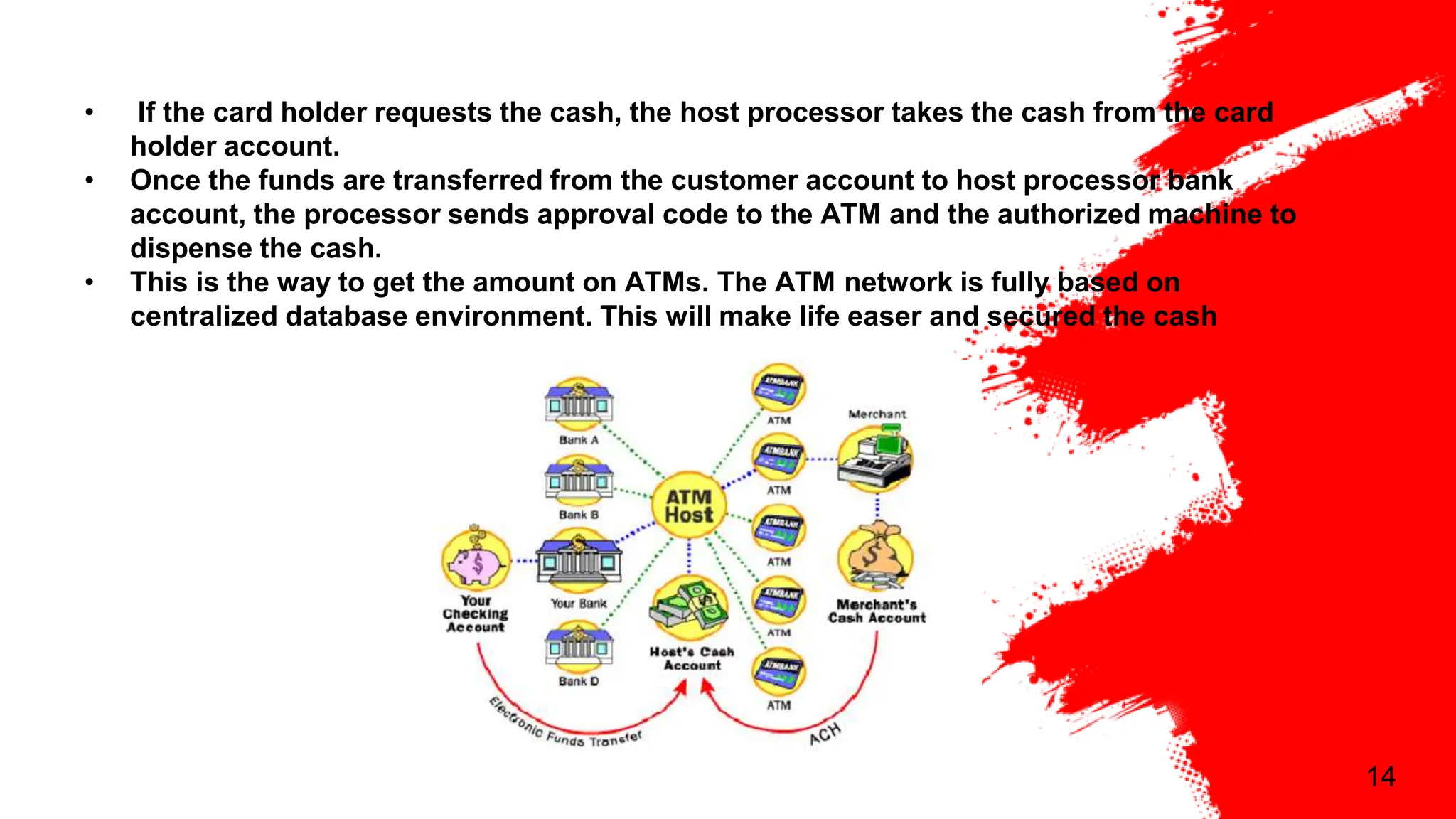

The document provides an overview of Automated Teller Machines (ATMs), detailing their functionality, components, and security features. It explains how ATMs allow customers to perform banking transactions independently through input devices like card readers and keypads, as well as output devices such as receipt printers and cash dispensers. Additionally, it discusses ATM networking, types of ATMs, and their working principles within a centralized database system.