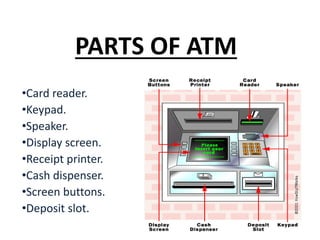

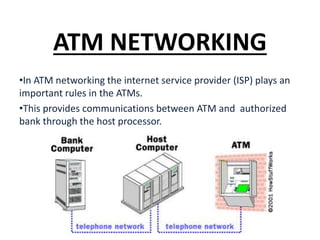

The document provides a comprehensive overview of Automated Teller Machines (ATMs), including their history, types, components, networking, and security features. It discusses the advantages and disadvantages of ATMs, emphasizing their 24-hour service and convenience, while also highlighting security concerns such as theft and fraud. The conclusion asserts that ATMs are efficient and reliable banking tools, often referred to as 'all time money' in India.