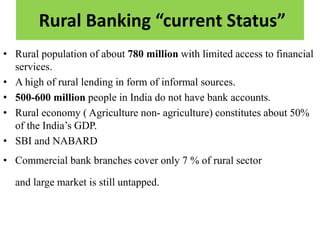

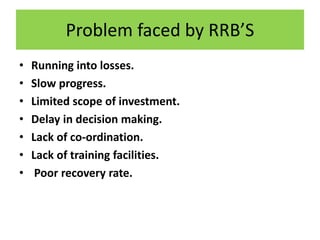

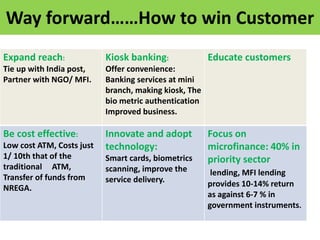

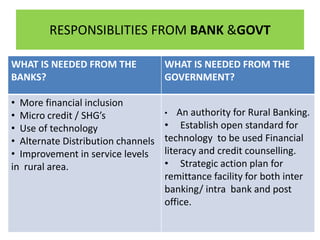

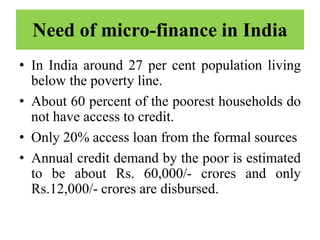

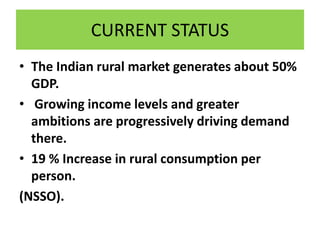

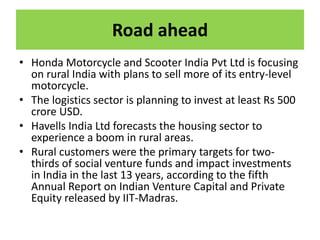

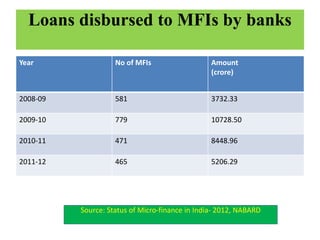

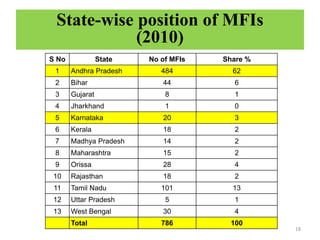

Rural banking in India aims to provide financial services to customers in rural areas. The objectives include saving rural people from money lenders, accelerating economic growth, and encouraging entrepreneurship. Currently, rural populations have limited access to services, with many relying on informal sources. Regional Rural Banks were established to increase credit flow, but commercial bank branches still only cover 7% of rural sectors. Microfinance is an important approach, with self-help groups being a major model. Issues include regional imbalances, poor management, lack of support, and ensuring sustainability. Expanding reach through partnerships and technology, as well as financial literacy, are keys to further progress.