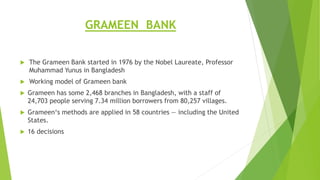

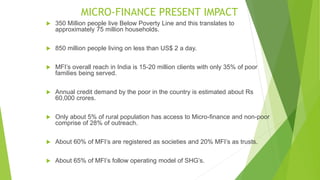

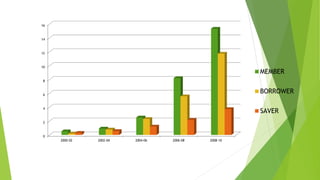

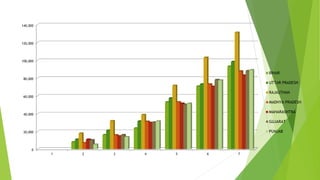

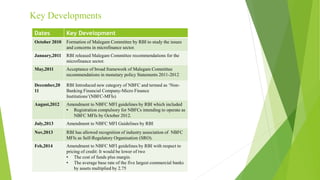

Microfinance in India provides small loans, savings, and insurance to low-income individuals who lack access to traditional financial services. Common microfinance models in India include self-help groups and programs based on the Grameen Bank in Bangladesh. The microfinance sector has grown substantially over the past decade but still reaches only a small portion of the rural poor. Ongoing challenges include expanding access to remote areas, developing new products, and attracting long-term financing for continued growth.