Embed presentation

Downloaded 136 times

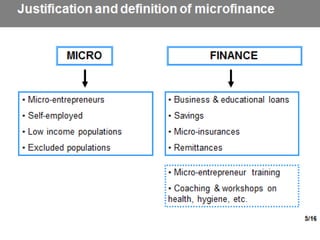

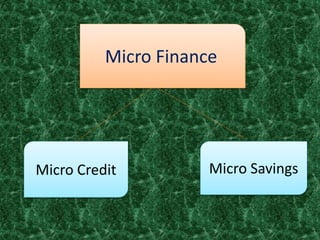

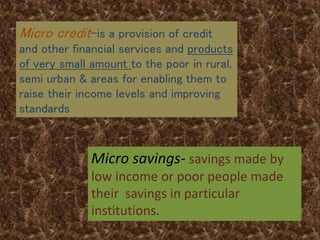

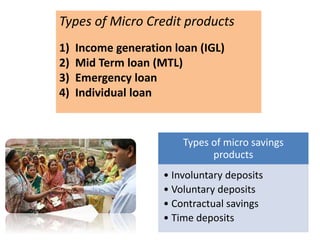

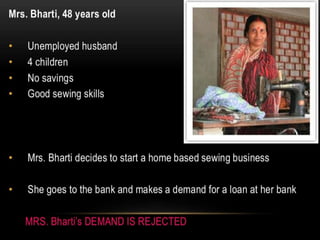

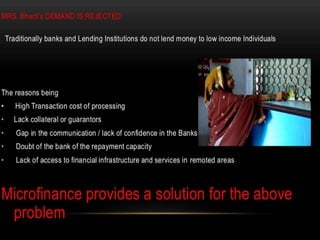

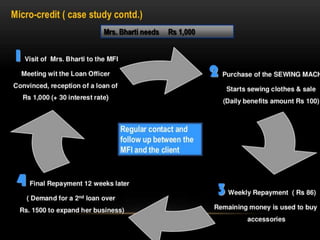

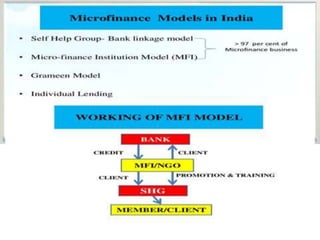

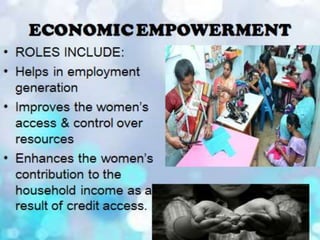

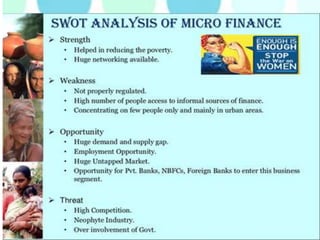

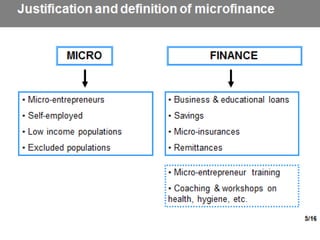

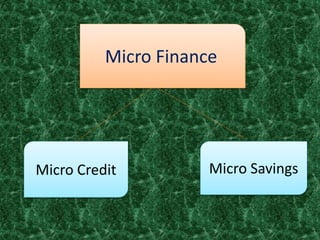

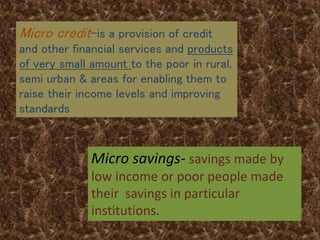

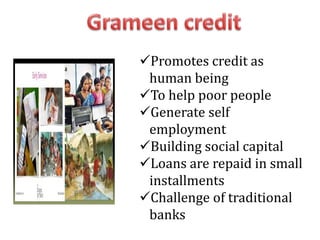

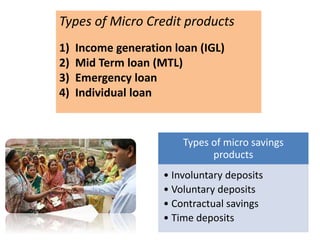

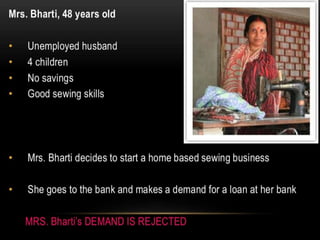

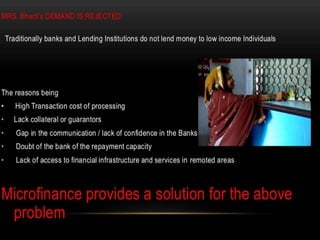

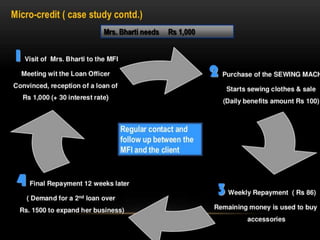

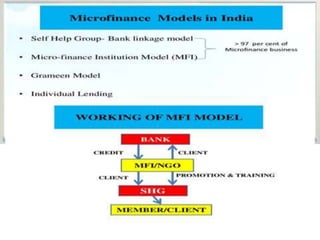

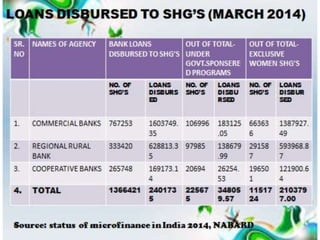

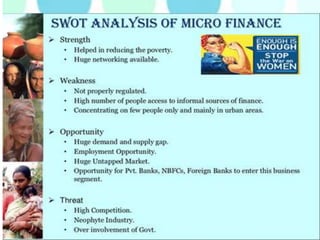

Microfinance involves providing small amounts of credit and other financial services to low-income individuals. It aims to help the poor generate self-employment and raise their income levels through microcredit loans that are repaid in small installments. Microsavings allows the poor to save small amounts in institutions. There are various types of microcredit and microsavings products that target the needs of low-income individuals. However, microfinance services still need to address challenges of lack of awareness, infrastructure issues, and doubts among potential users. Expanding proximity and improving security and staff attitudes can help promote greater access and use of microfinance.