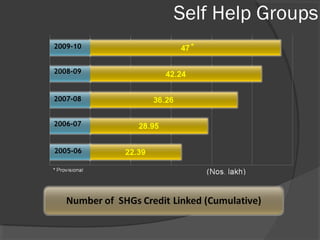

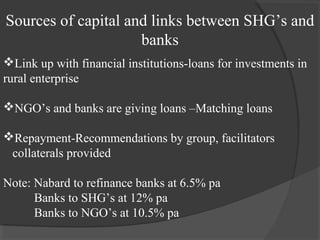

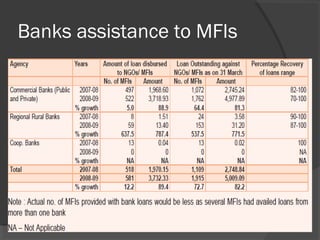

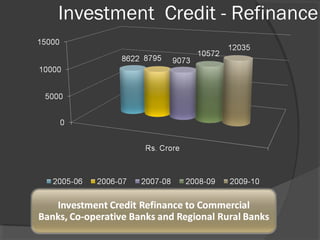

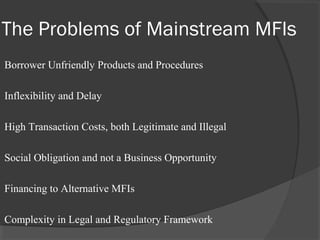

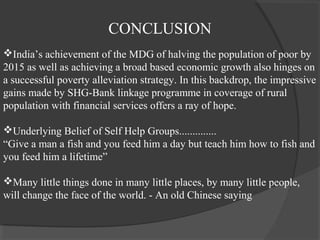

This document presents information on microfinance in India. It discusses how microfinance provides financial services like credit, savings and insurance to poor individuals. It notes that microfinance aims to improve livelihoods through capital provision. The document provides statistics on microfinance in India and outlines the roles of various regulatory bodies. It discusses self-help groups and their importance in poverty alleviation. It also examines the role of banks in providing assistance to microfinance institutions and some problems faced by these institutions. Finally, it proposes various solutions and concludes by emphasizing the potential of self-help groups and microfinance to reduce poverty in India.