This document provides a table of contents for a project on microfinance and private equity investment. It outlines the objectives of studying the evolution of microfinance, business models, funding needs, and private equity deals in India. Microfinance institutions face acute funding shortages due to delayed loan repayment cycles. The research aims to understand this growing sector and investment opportunities despite challenges like over-indebtedness of borrowers. Various sources are referenced to collect data on microfinance institutions, regulations, and deals in India.

![Funding to MFI’s worldwide by PE’s, VC’s and HNI’s

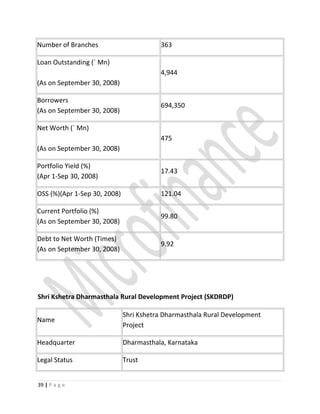

Blue Orchard , a commercial microfinance investment intermediary based in

Switzerland, has, through its Private Equity fund, invested Rs 500 million (the

equivalent of over USD 10.2 million) in the equity of Asmitha Microfin Limited , a

Microfinance Institution (MFI) based in Hyderabad, India. This was announced in a

press release available on the Asmitha website. Microcapital covered the

relationship between these two organizations in October of 2008 when

BlueOrchard made an initial equity investment in Asmitha of USD 5.3 million

intended to “expand [the MFI's] capital base and bolster its borrowing capacity” .

According to Dr. Vidya Sravanthi, Chairperson and Managing Director of Asmitha,

the MFI hopes to use the newest investment to “[expand] its operations deeper

into the Indian rural markets and offering its services to many more of the under-

served poor in these regions” as well as move toward “growth targets” set by

Blue Orchard .

Asmitha was founded in 2002 in an effort to give “rural poor women access to

financial resources in the form of collateral free small loans” . In fact, the Mix

Market, the microfinance information clearinghouse, shows that 100 percent of

Asmitha’s loans are provided for women . Now, according to Dr. Sravanthi,

Asmitha has one of the top-five biggest loan portfolios of any MFI in India at USD

165 million (as of July 31, 2009), and “serves over 1.16 million clients” . It was also

ranked 29th in a Forbes list of the top 50 MFIs in 2007, a list that was highlighted

by MicroCapital in January 2008 . According to the Mix Market, as of March 31,

2009, Asmitha has a 5.33 percent return on assets, a 55.52 percent return on

equity, a capital/asset ratio of 10 percent, and a gross loan portfolio to total

assets ratio of 61.37 percent .

BlueOrchard’s Private Equity fund was launched at the end of 2007 in an effort to

“[forge] long-term partnerships with MFIs worldwide” . Though the parent

company is Swiss, the Private Equity fund is registered in Luxemburg, and is

managed through BlueOrchard Investments, a subsidiary of BlueOrchard set up to

“[invest] in the equity of microfinance institutions and microfinance network

funds (family of MFIs)” . According to BlueOrchard’s annual report, the fund has

53 | P a g e](https://image.slidesharecdn.com/6thsem100marks-150630055348-lva1-app6891/85/Microfinance-53-320.jpg)

![raised USD 131.1 million in total assets after just one year of existence, as of

December 31, 2008 . These assets have been defined as “committed capital,” or

funds to be invested in MFIs and/or network funds .

BlueOrchard also has various other assets under management. These funds were

highlighted by Microcapital in June of 2009 in an interview with Jean-Pierre

Klumpp, the Chief Executive Officer of BlueOrchard. The largest fund in terms of

assets under management is the Dexia Micro-Credit Fund . Founded in 1998 by

the Dexia Banque Internationale à Luxembourg , the fund is “the first commercial

investment fund designed to refinance microfinance institutions specialised in

financial services to small companies in emerging markets” . It is managed by

BlueOrchard’s other subsidiary, BlueOrchard Finance, who specialize in providing

loans to MFIs. According to Mr. Klumpp, the Dexia Micro-Credit Fund has USD 477

million assets under management as of May 2009, extends to almost 100 MFIs in

30 countries, and reaches over 400,000 clients .

BlueOrchard Finance, along with Edmond de Rothschild Asset Management, “an

investment banking subsidiary of LCF Rothschild Group,” also manages The Saint-

Honoré Microfinance Fund, which invests in “local and regional investment funds,

MFI network funds, cooperatives, etc,” and has assets under management of over

USD 14.3 million as of May 2009 .

Additionally, BlueOrchard is an advisor to the portfolio of BBVA Codespa

Microfinance Fund , a regional fund in Latin America with assets under

management of over USD 40 million as of May 2009 [11]. Microcapital [16]

covered the launch of this “microfinance hedge fund”.

There are also three collateralized debt obligations (CDOs), funds backed by

securities, that BlueOrchard Finance uses to finance MFIs. These CDOs are

BlueOrchard Microfinance Securities , which [offers] US private and institutional

investors [an] … opportunity to acquire notes collateralised by MFI debt

obligations,” BlueOrchard Loans for Development, which works with Morgan

Stanley to “[offer] 5-year funding at fixed rates to 21 fast growing MFIs in 13

countries,” and BlueOrchard Loans For Development , which was the first

“significant CDO” to have a joint launch with a major investment bank (Morgan

54 | P a g e](https://image.slidesharecdn.com/6thsem100marks-150630055348-lva1-app6891/85/Microfinance-54-320.jpg)

![Stanley) in order to fund microfinance. As of December 31, 2008, these CDOs

have a combined portfolio value of USD 277.4, according to Blue News [, a “social

performance report” by BlueOrchard.

Microcapital covered these varied funds in a June 2009 article about a USD 28

million disbursement made by BlueOrchard. Additionally, this article covered the

Microfinance Enhancement Facility (MEF) , a facility co-managed by BlueOrchard,

ResponsAbility Social Investments , who “combine traditional financial

investments with social returns, and Cyrano Management , “a corporation

specialized in financial institutions and investment funds that service small

businesses”. The facility was started by the International Finance Corporation

(IFC) , the investment and advice portion of the World Bank working in the private

sector, and KfW Entwicklungsbank , a development bank that has the goals of

“reducing poverty, making globalisation fair, conserving natural resources and

ensuring peace”. The MEF has undertaken the task of helping MFIs refinance

amidst the financial crisis, and had “new investments [totaling] $16.2 billion in

fiscal 2008,” according to a press release .

BlueOrchard, as a complete entity, is not listed on the MIX Market. However,

from BlueOrchard’s annual review, it is shown that the company’s “partner MFIs”

experienced an average asset growth of 45 percent in 2008 and that BlueOrchard

funds “reached more than 9 million micro-entrepreneurs, a majority of them

women . Additionally, Blue News shows that, as of January 2009, BlueOrchard has

“nearly USD 870 million [assets] under management” with returns on these

“investment products between 4 and 10 percent – depending on each

microfinance investment vehicles’ strategy”

Serial investor Kalpathi Suresh--the founder of SSI Ltd who sold 51% stake in the

IT training firm to PVP Global for $140 million in 2007—is no stranger to scripting

big-ticket exits.

This time, aided by a raging investor appetite for well-managed microfinance

assets, he netted over 12x returns in just about two years by selling his stake in

Chennai-based Equitas Micro Finance to Sequoia Capital.

55 | P a g e](https://image.slidesharecdn.com/6thsem100marks-150630055348-lva1-app6891/85/Microfinance-55-320.jpg)