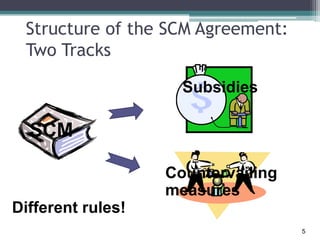

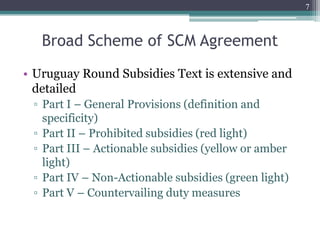

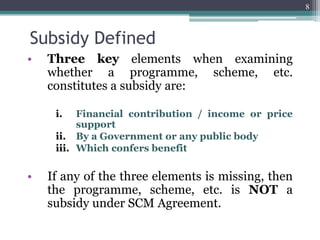

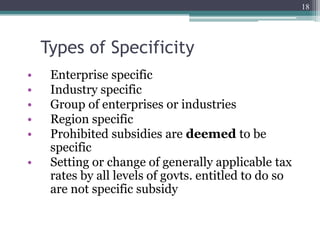

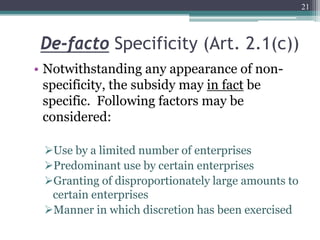

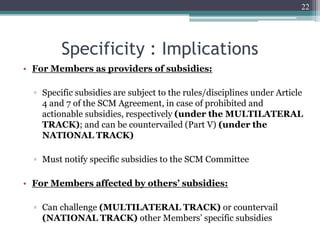

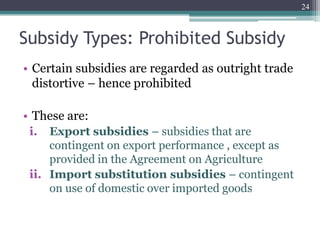

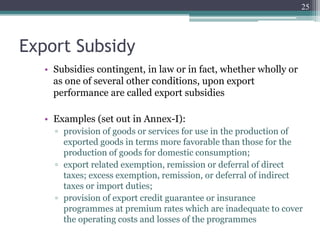

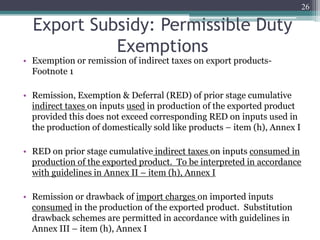

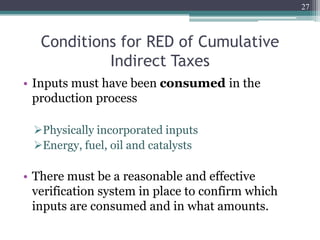

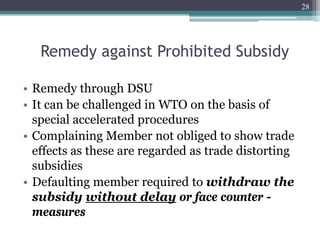

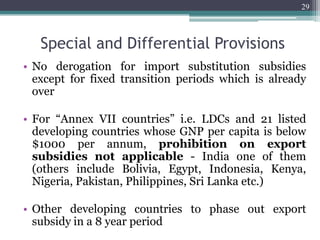

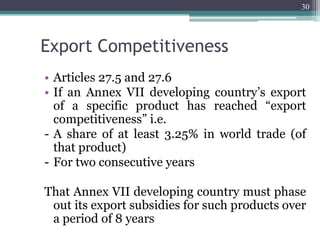

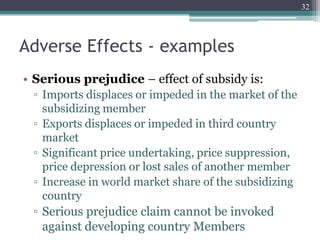

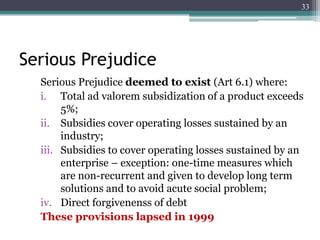

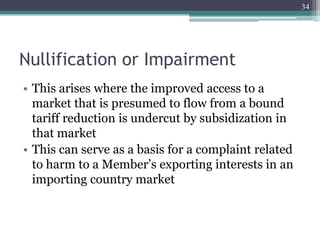

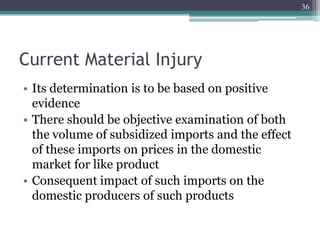

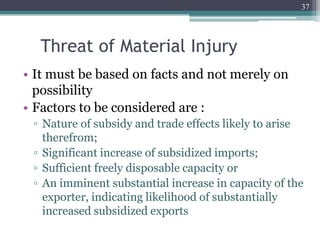

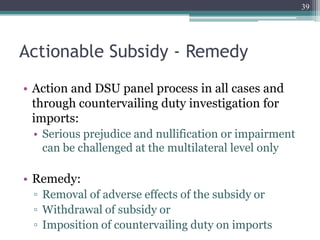

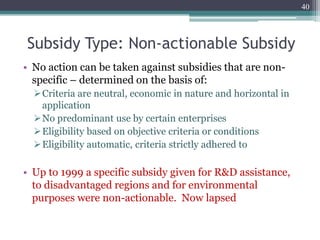

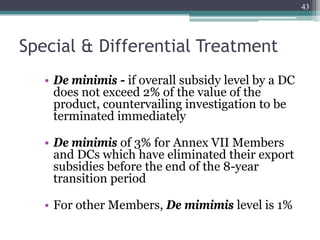

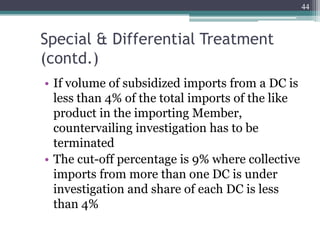

The document discusses key aspects of the WTO Agreement on Subsidies and Countervailing Measures (SCM Agreement). It outlines the different types of subsidies - prohibited, actionable, and non-actionable - and the rules governing each. Prohibited subsidies include export subsidies and import substitution subsidies. Actionable subsidies are those that cause adverse effects like injury to domestic industry. Non-actionable subsidies are those that are non-specific. The agreement also provides special and differential treatment for developing countries in areas like de minimis subsidy levels and volume thresholds for countervailing investigations. Remedies under the agreement include withdrawal of subsidies or imposition of countervailing duties.