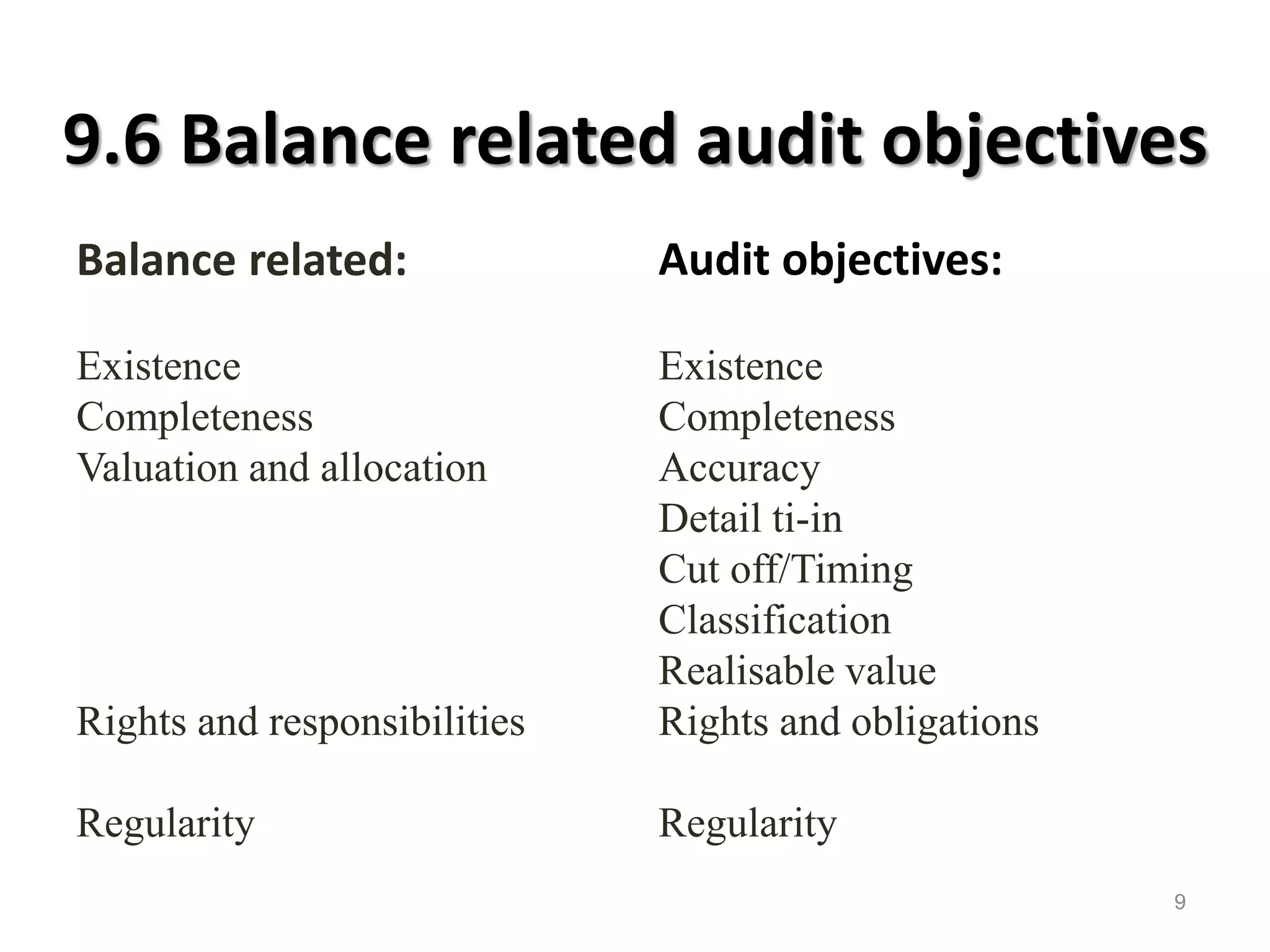

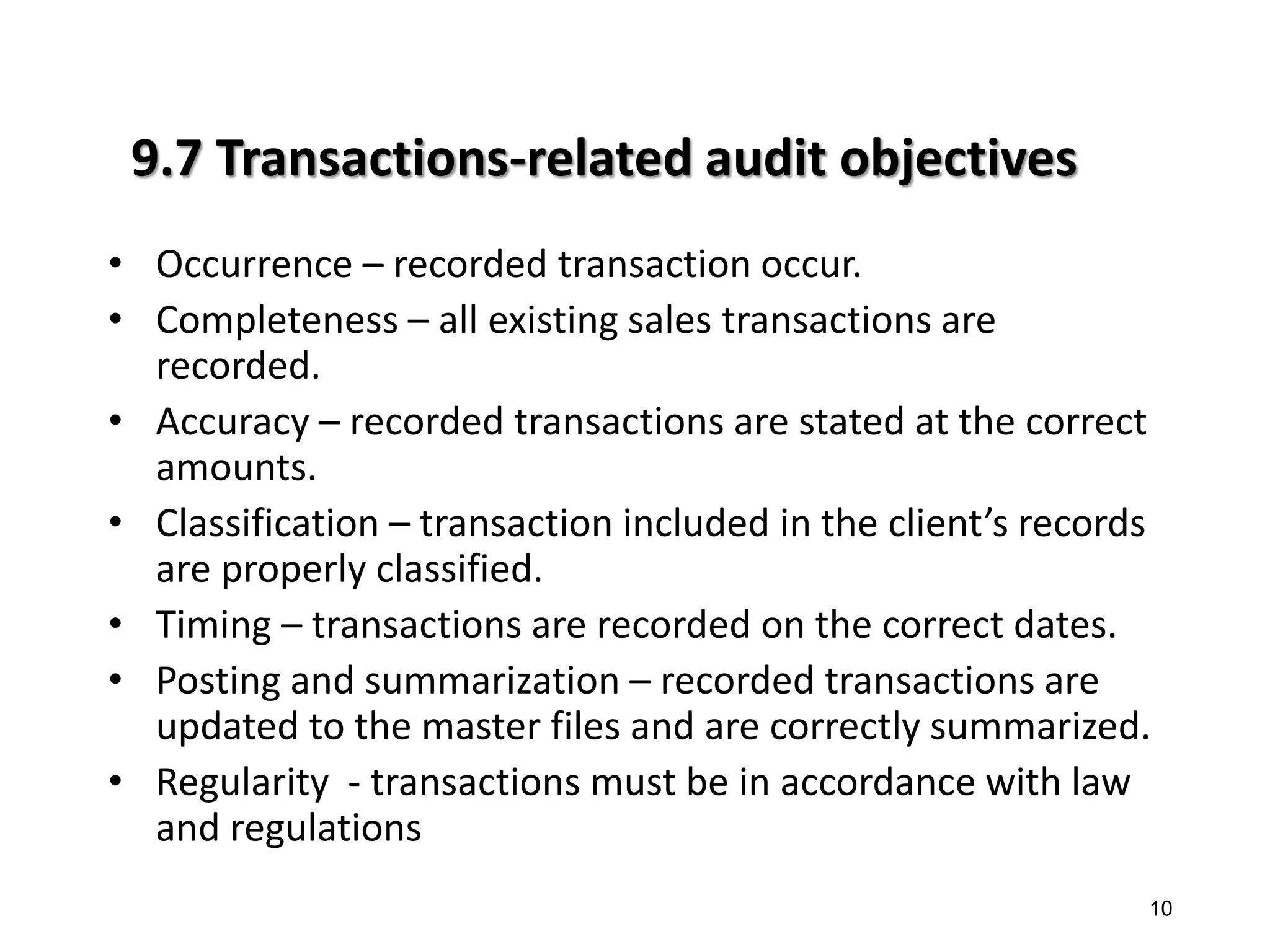

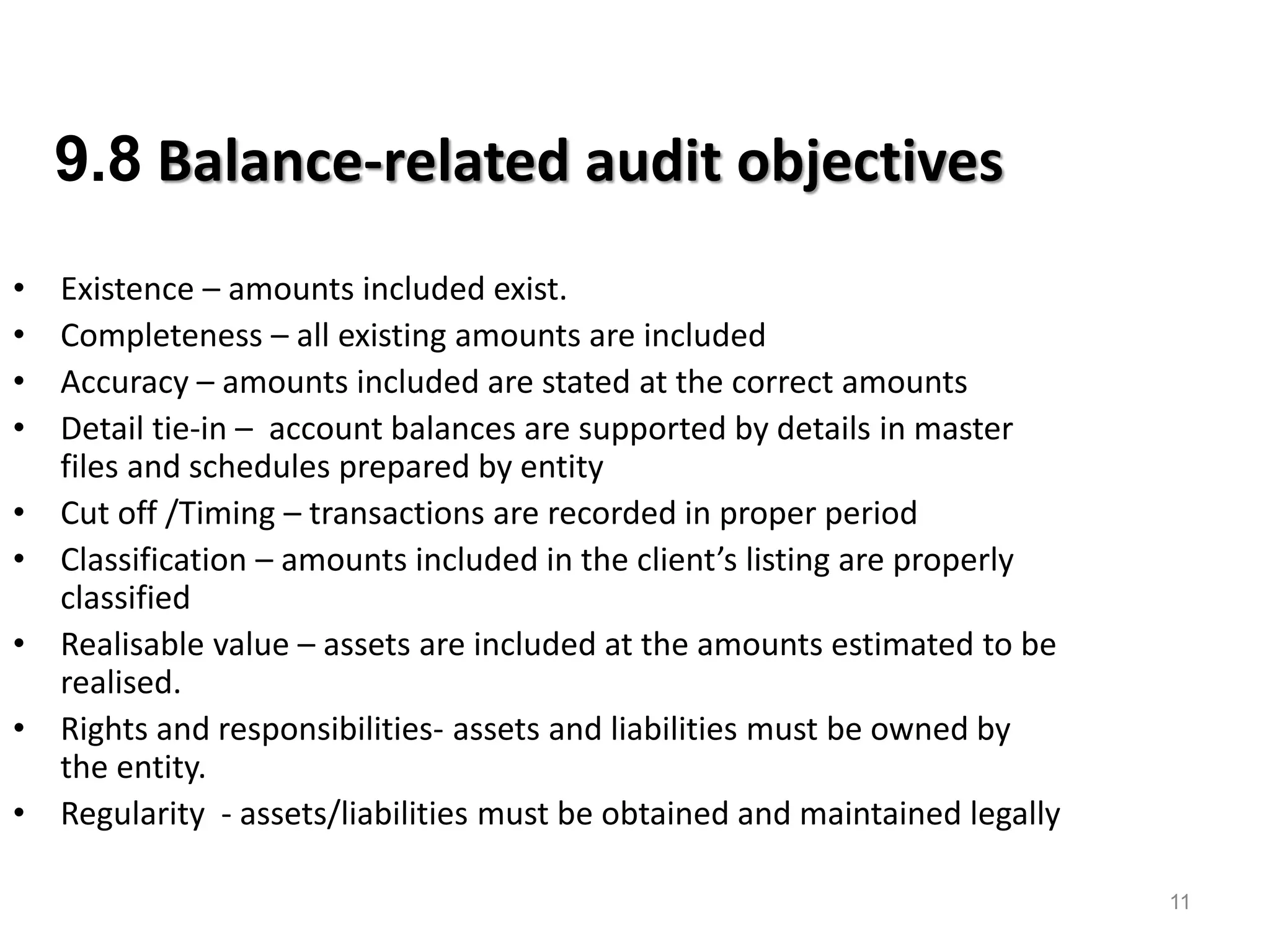

This document discusses controls and audit objectives for system-based auditing. It outlines two levels of control: control environment and control activities. The control environment includes factors like ethical values, risk awareness, operating procedures, organizational structure, staff competence, and management oversight. Control activities are specific policies and procedures to address risks, like separation of duties, authorization of transactions, documentation, and asset protection. The document also distinguishes between transaction-related and balance-related audit objectives, providing examples of objectives for both categories like occurrence, completeness, accuracy, and regularity.