This document outlines the procedures for finalizing an audit, including:

1) Performing final analytical reviews to assess reasonableness of accounting estimates and consistency with prior periods and forecasts.

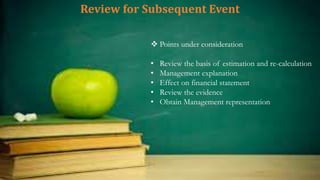

2) Reviewing for contingent liabilities and subsequent events.

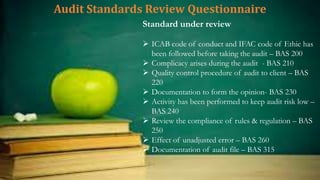

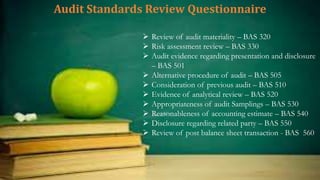

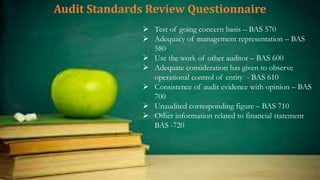

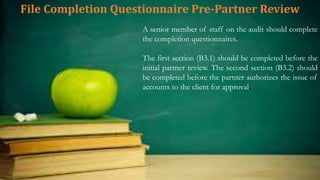

3) Completing questionnaires to ensure compliance with auditing standards and that all necessary procedures were performed.

4) Accumulating and evaluating all audit evidence before issuing an audit report and communicating with management.