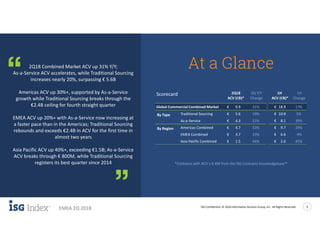

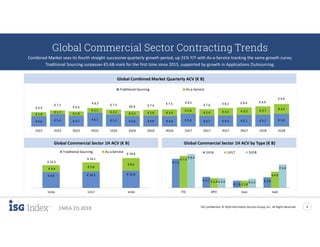

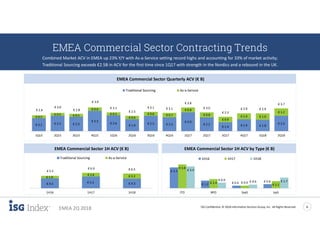

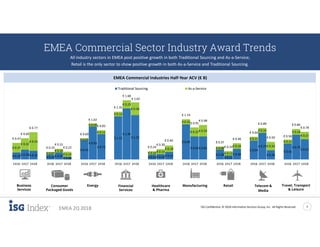

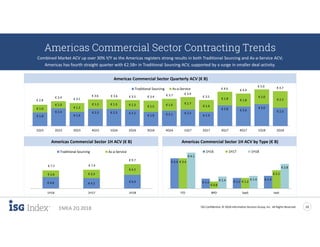

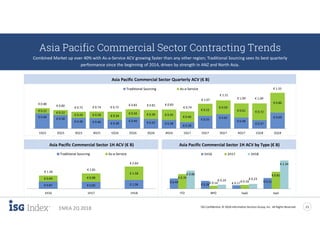

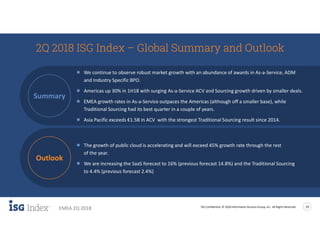

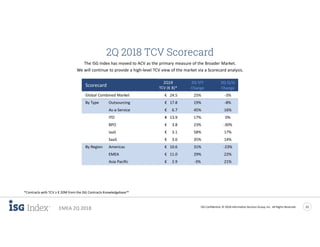

The ISG Index for the second quarter of 2018 reports significant growth in the global commercial contracting market, with an overall annual contract value (ACV) increase of 31% year-over-year. As-a-service ACV experienced a notable surge of 51%, surpassing traditional sourcing, which also grew by 19%. EMEA showed strong recovery trends, particularly in traditional sourcing, while the Asia Pacific region observed the highest growth at 40%.