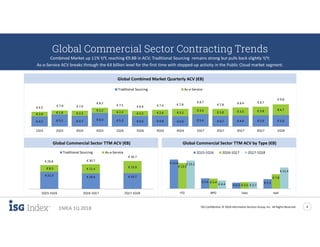

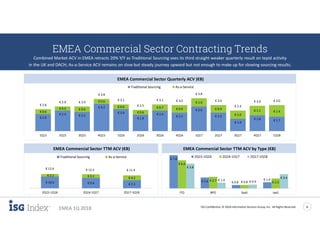

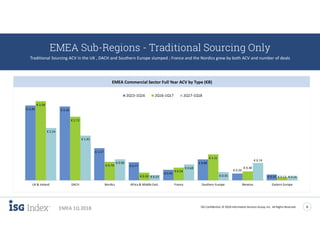

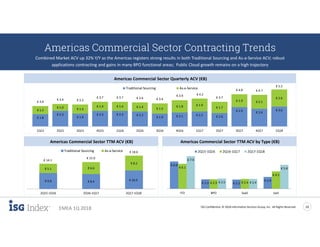

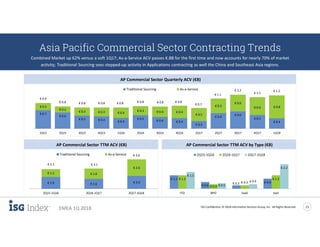

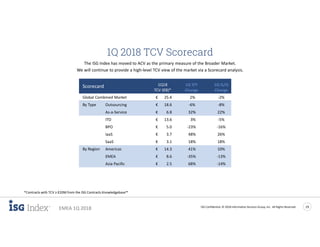

In the first quarter of 2018, the global commercial combined market saw an 11% year-over-year increase in annual contract value (ACV), totaling €9.8 billion, driven by a 40% increase in as-a-service offerings, while traditional sourcing experienced a decline of 6%. The Americas performed strongly with a 32% ACV increase, whereas the EMEA region faced challenges with a 20% decline, particularly in the UK and DACH markets. Asia Pacific showcased significant growth, with a 62% increase in ACV and as-a-service surpassing €0.8 billion for the first time.