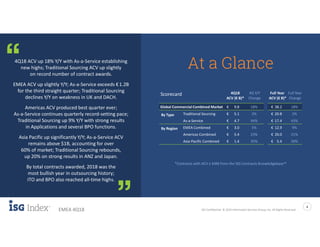

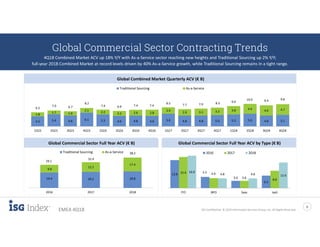

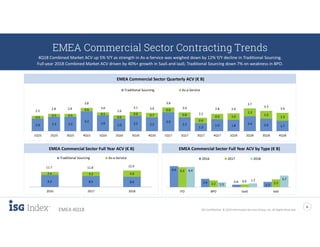

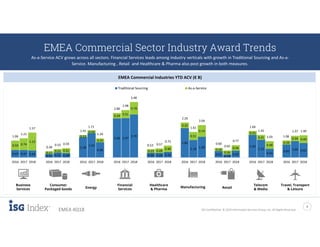

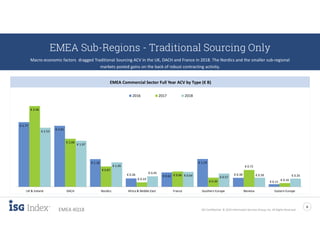

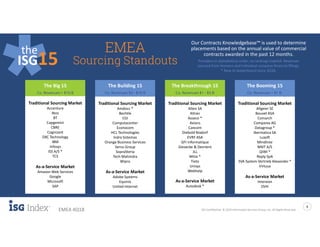

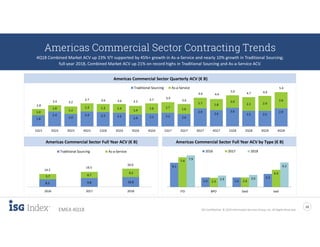

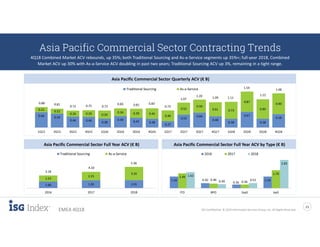

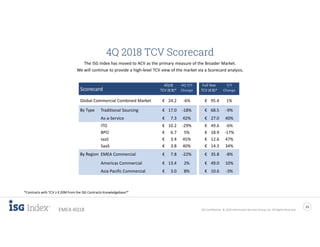

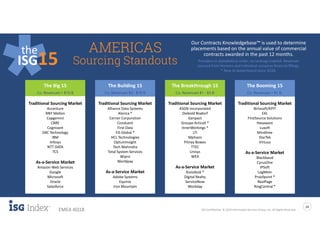

The document provides insights into the EMEA sourcing and as-a-service market as of Q4 2018, highlighting significant growth in as-a-service contracts with an 18% year-over-year increase in the global commercial market ACV. Additionally, traditional sourcing saw slight growth, but overall ACV for traditional sourcing in EMEA declined due to macroeconomic challenges. The document underscores regional variations, with the Americas and Asia Pacific showing strong performance while EMEA struggled, indicating a dynamic but uneven market landscape.