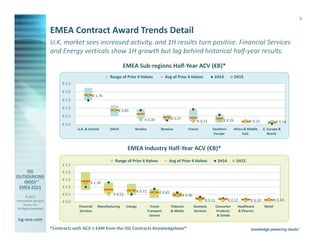

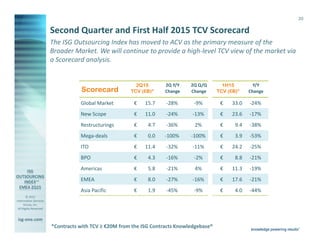

The ISG Outsourcing Index for Q2 2015 provides insights into the EMEA outsourcing market, noting a global ACV of €4.9 billion, a 24% increase quarter-over-quarter but a 7% decrease year-over-year. The report highlights a record-high number of awards for the quarter, despite a 14% decline in half-year ACV from the previous year. Additionally, the Americas experienced a strong growth with a 29% increase in ACV and a record count of contracts.