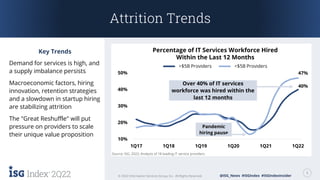

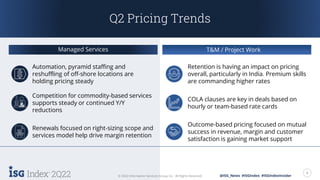

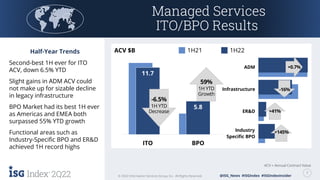

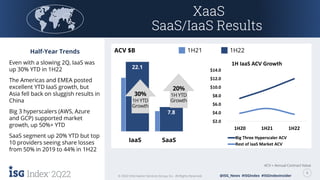

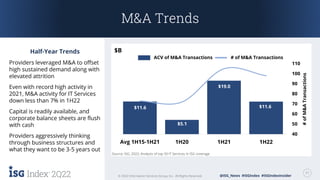

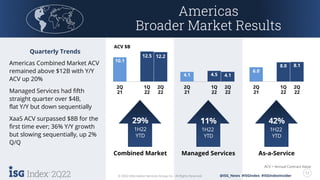

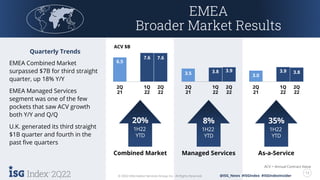

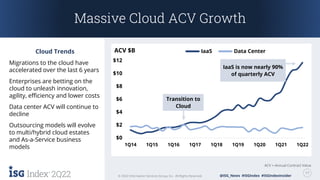

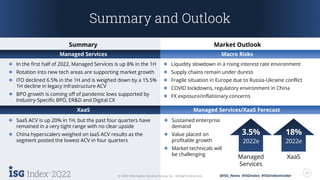

The document presents insights on the managed services and as-a-service market trends for Q2 2022, highlighting a 9% year-over-year growth in combined market activities while noting stabilization in attrition rates amidst a tight labor market. It emphasizes the importance of various factors such as macroeconomic conditions and hiring strategies, alongside ongoing strong contracting activity, particularly in specific sectors like engineering and industry-specific BPO. Additionally, it discusses challenges in pricing trends and the accelerating shift towards cloud solutions, underscoring a need for comprehensive cloud strategies within enterprises.