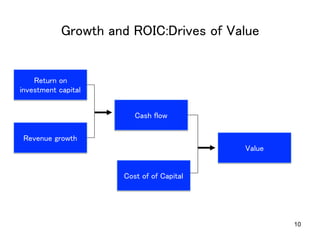

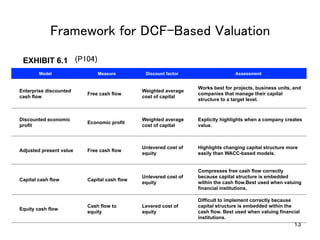

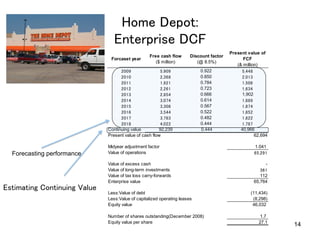

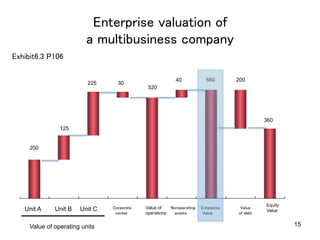

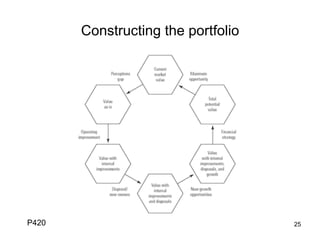

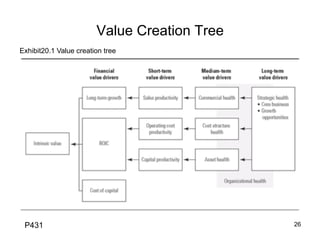

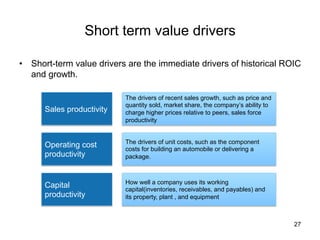

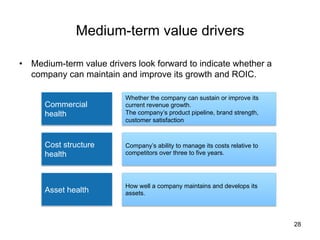

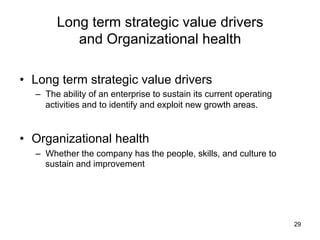

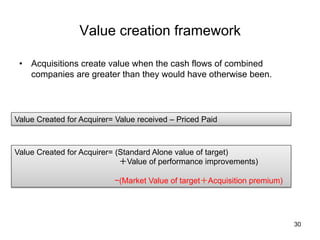

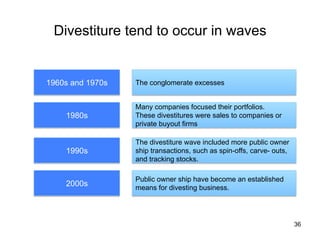

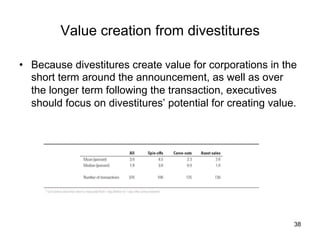

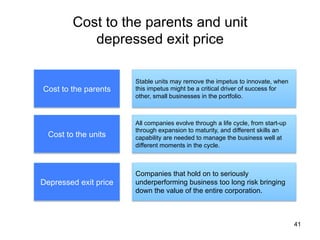

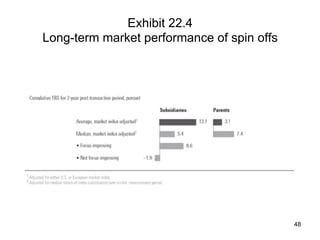

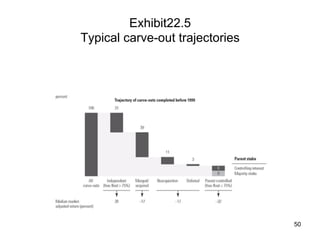

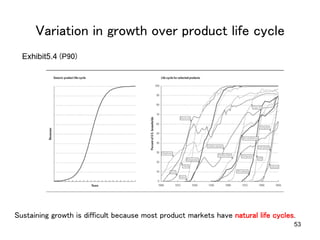

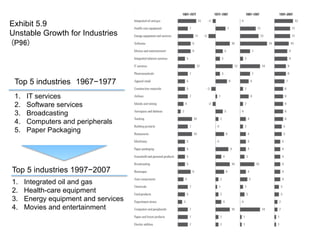

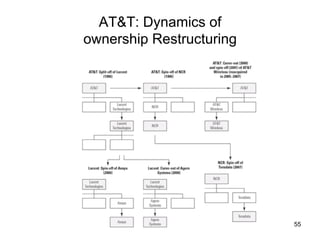

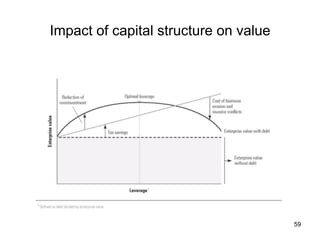

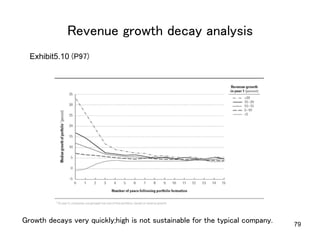

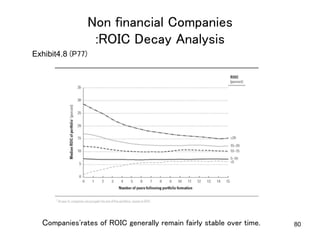

This document summarizes the contents of a valuation training seminar. It begins with introductions and then outlines the six parts of the seminar: foundations of value, core valuation techniques, intrinsic value and the stock market, managing for value, advanced valuation issues, and special situations. It then discusses key concepts from various parts, including how growth and return on invested capital drive value, frameworks for valuation, adjusting financial statements, and creating value through mergers, acquisitions, and divestitures. Case studies and exhibits are referenced throughout. The overall document provides an overview of the strategic and technical aspects of valuation covered in the seminar.