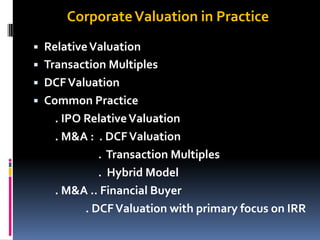

The document provides an overview of corporate valuation. It discusses the goal of valuation as estimating fair market value, defined as the price agreed between a willing buyer and seller with reasonable knowledge. Valuation is important for raising capital, IPOs, M&As, divestitures and other contexts. Approaches include book value, DCF, and relative valuation methods. Valuation requires information on the industry, company operations, finances, and projections. It can be biased, so methods aim to mitigate bias from perceptions, pressures or uncertainty. Managers should understand valuation to maximize value and exploit deviations between market and intrinsic value.