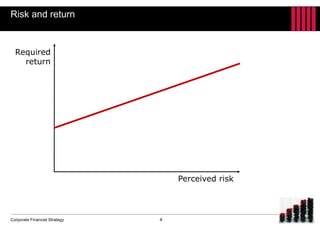

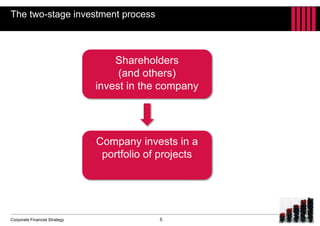

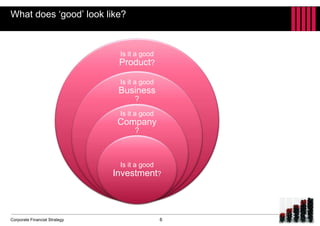

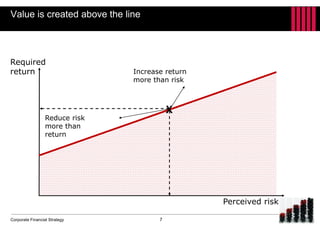

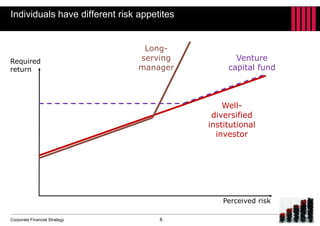

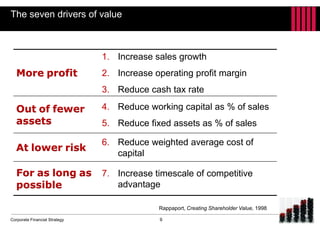

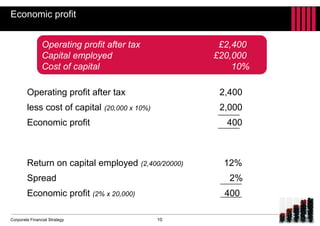

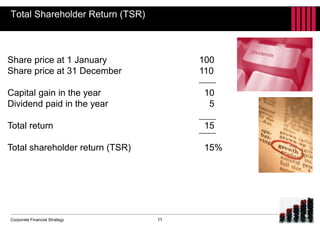

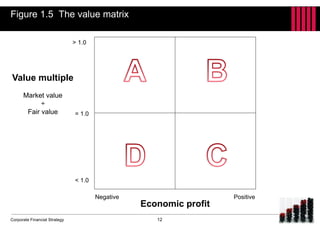

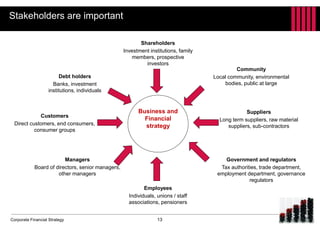

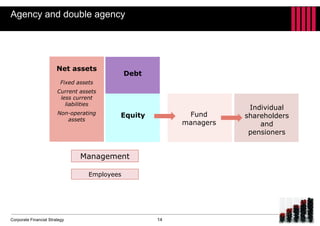

This chapter introduces corporate financial strategy and key concepts. It discusses setting the context for corporate financial strategy by covering risk and return relationships, the two-stage investment process, different models for measuring shareholder value like NPV, economic profit and total shareholder return. The chapter also addresses how value is created, stakeholders in corporate strategy, and issues of agency theory.