Embed presentation

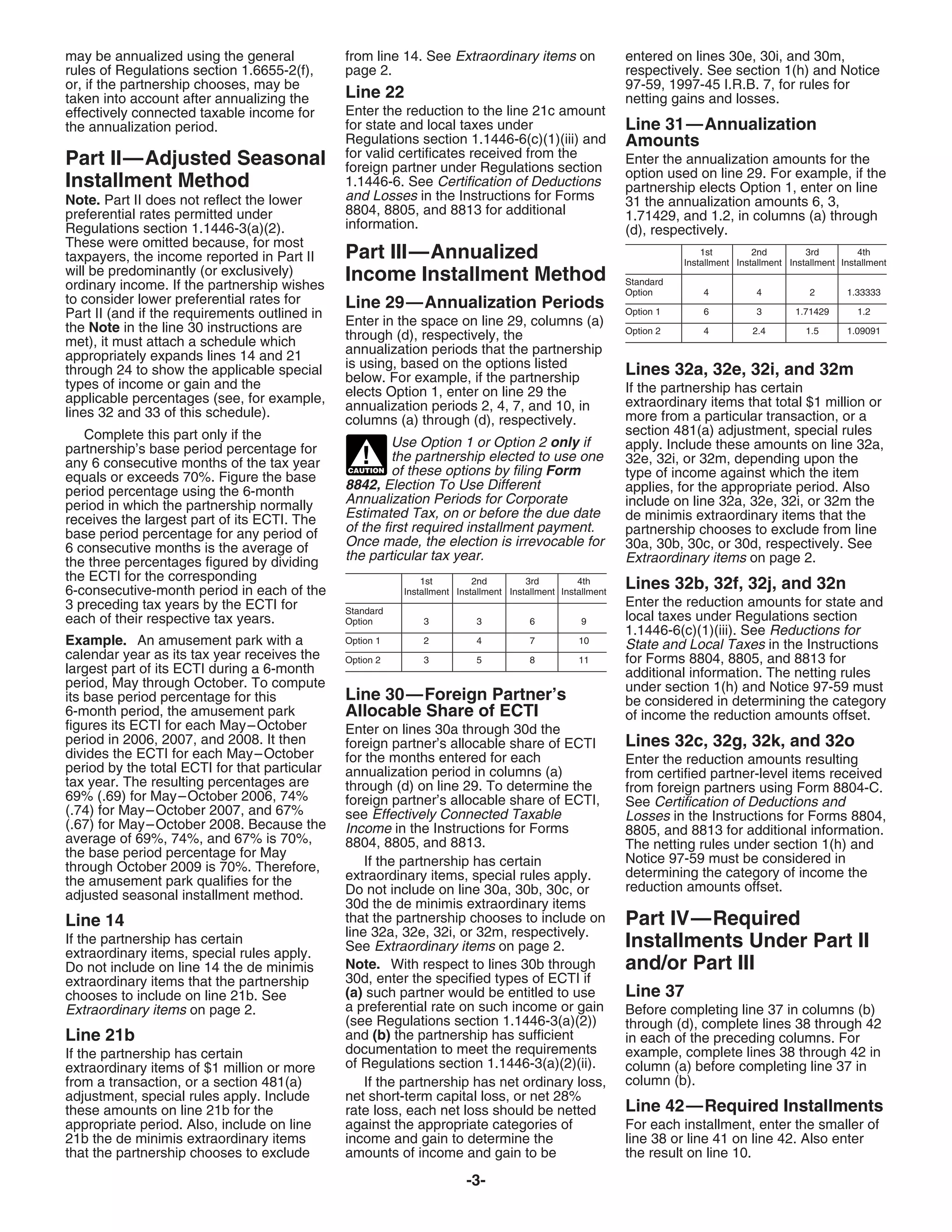

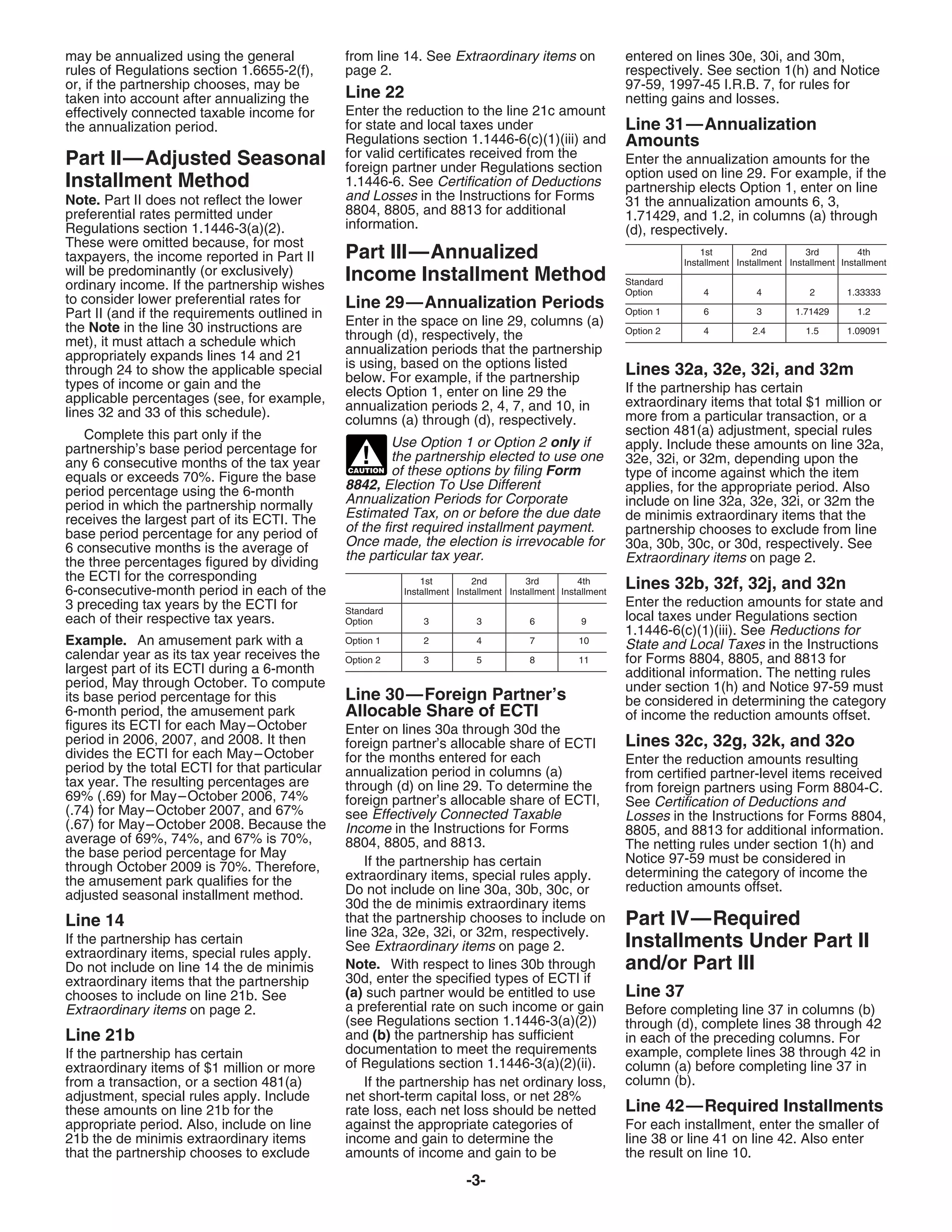

Download to read offline

This document provides instructions for partnerships to make estimated payments of Section 1446 tax, which is a tax on income from U.S. sources that is allocated to foreign partners. It explains how to calculate the required installment payments using either a current year safe harbor method or a prior year safe harbor method. It also describes how partnerships can annualize income over the course of the year or use adjusted seasonal calculations to potentially reduce installment payments. The document provides line-by-line instructions for completing Form 8804-W to determine the proper estimated Section 1446 tax payments.