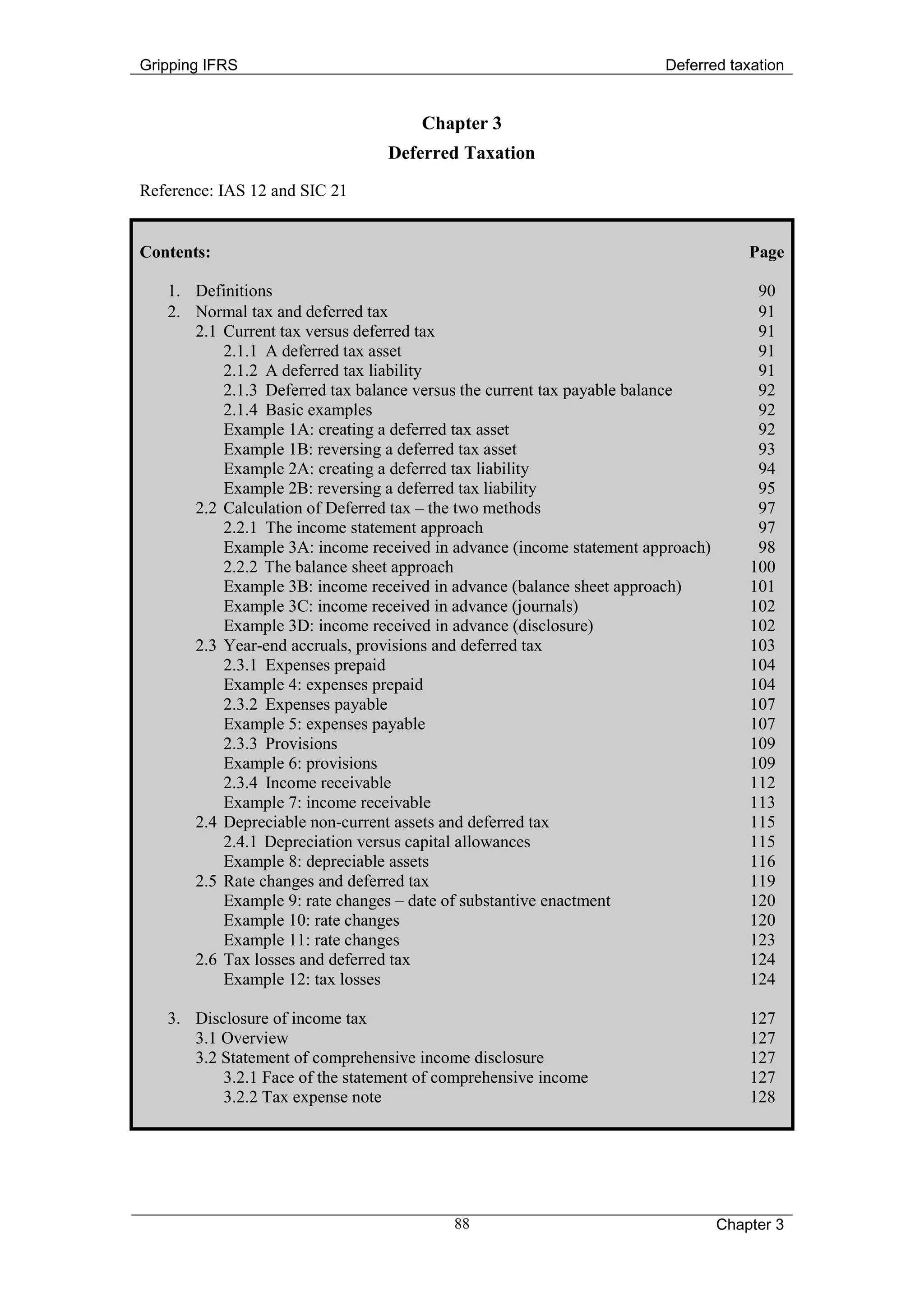

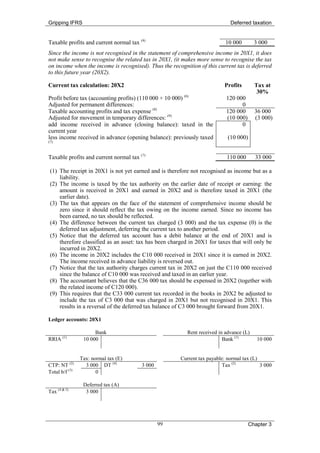

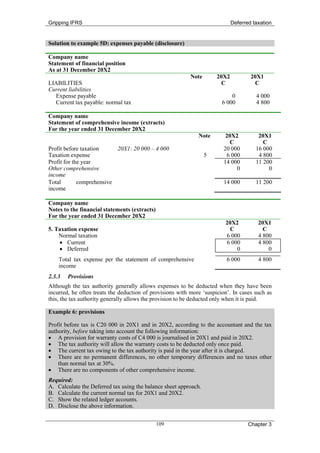

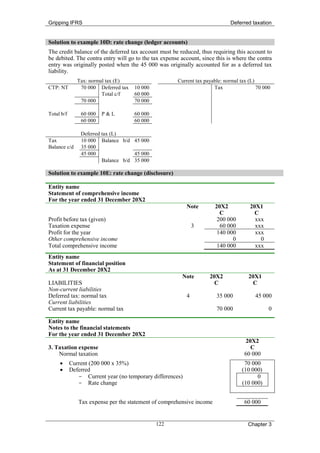

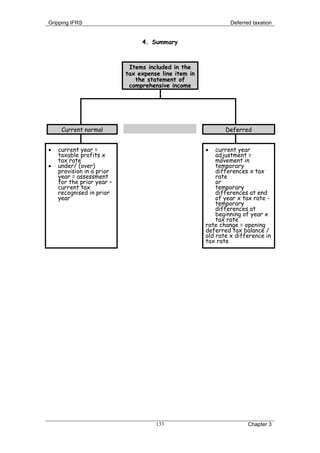

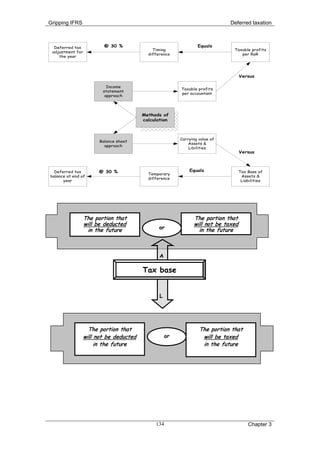

This document discusses deferred taxation. It begins by defining key terms related to current tax, deferred tax, temporary differences, tax base, and more. It then explains the difference between current tax and deferred tax, and how deferred tax assets and liabilities are created when there is a difference between the current tax charged and the tax expense calculated using the accrual concept. Several examples are provided to illustrate creating and reversing deferred tax assets and liabilities. The document also covers calculating deferred tax using the income statement and balance sheet approaches, as well as topics like year-end accruals, depreciation, tax rate changes, and tax losses. Finally, it discusses the disclosure requirements for income tax in the statement of comprehensive income, statement